Hello Traders,

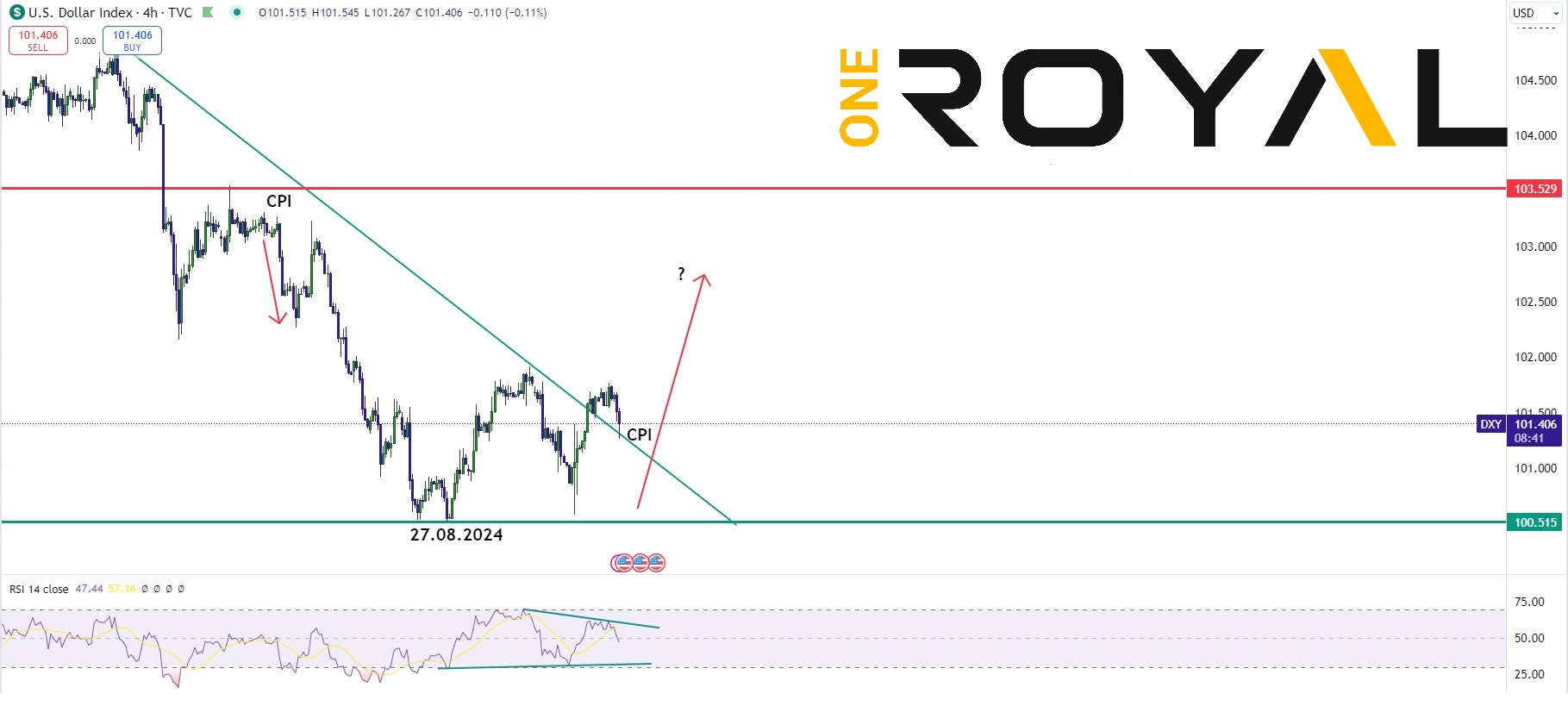

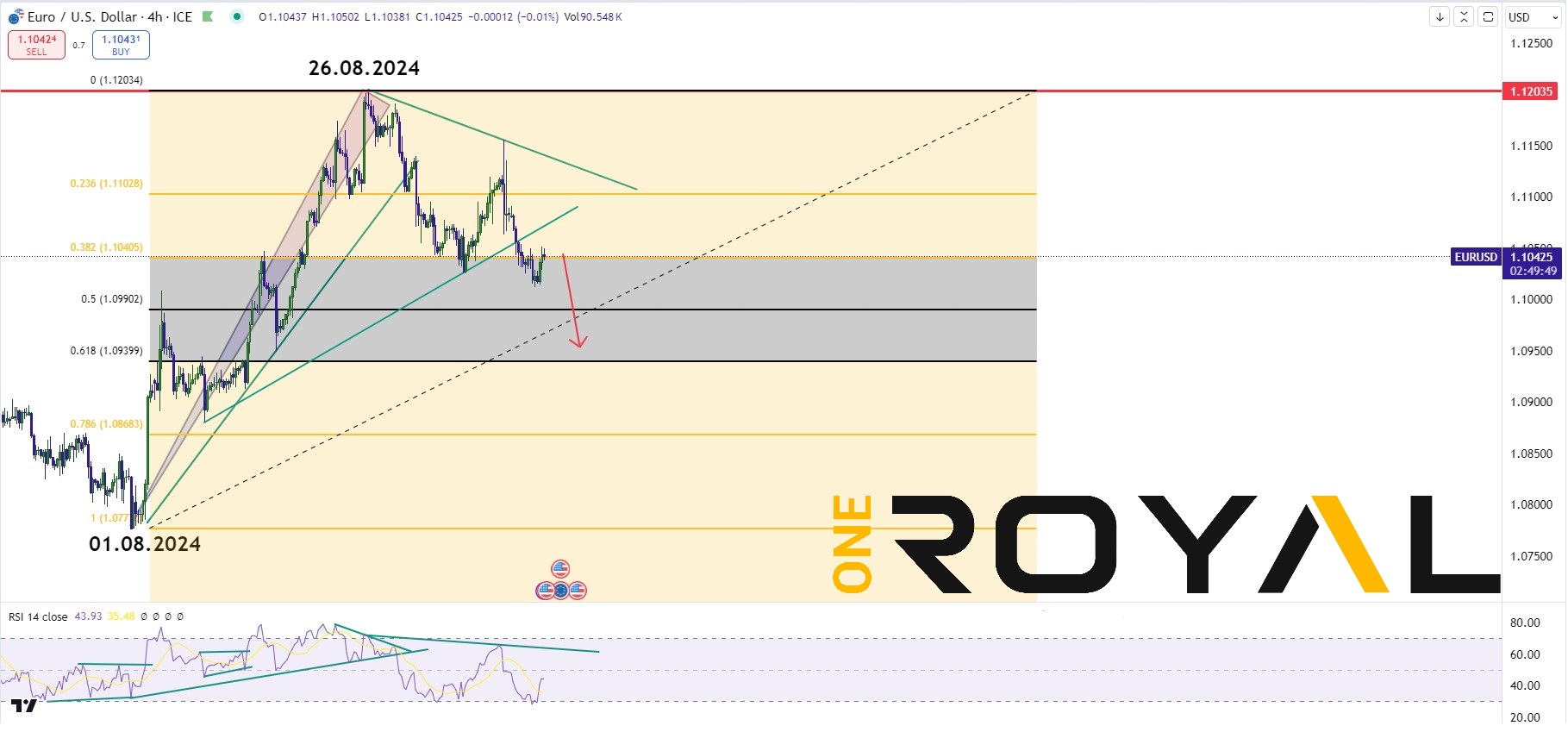

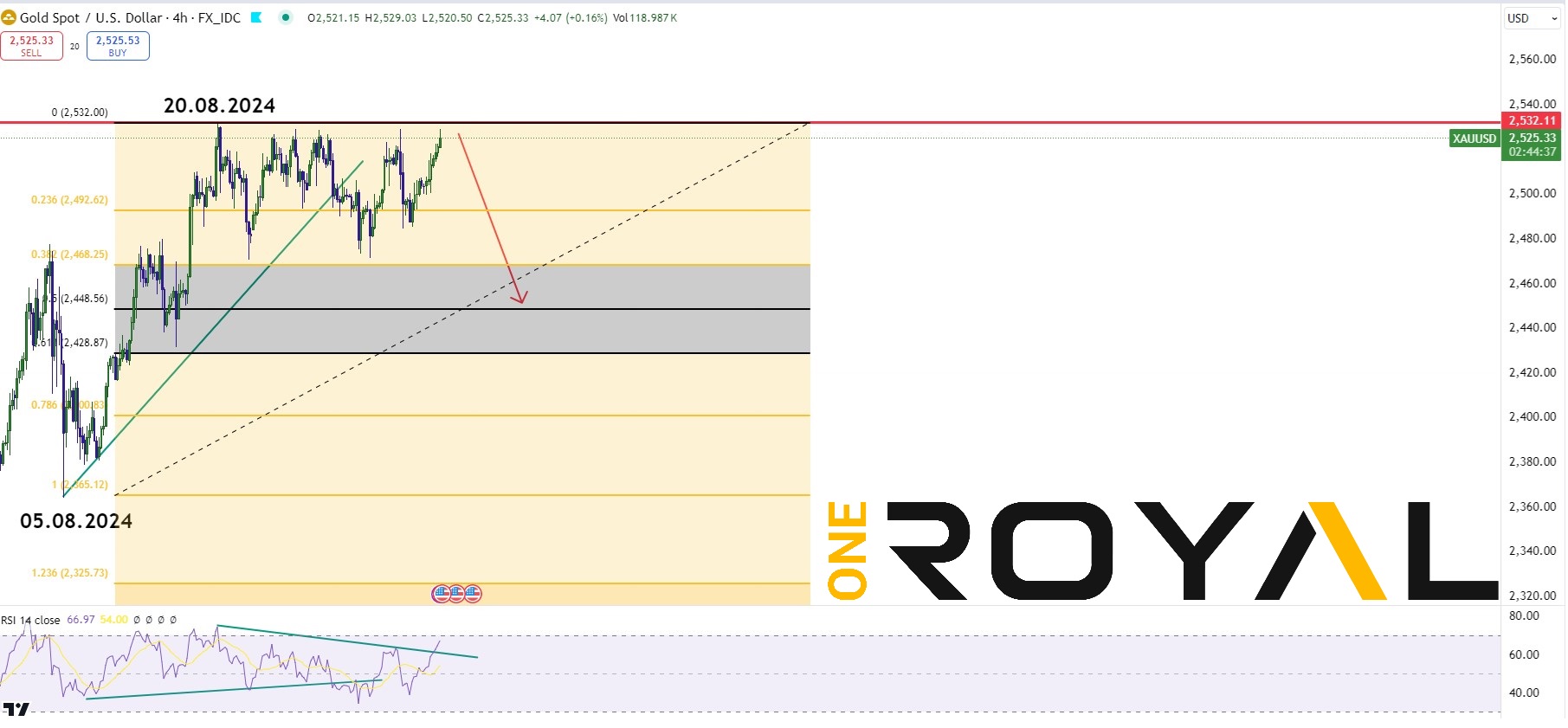

Good morning to all. We are trading within the London Session, a couple of hour before the US CPI Release which is on 13:30 GMT time. We will be presenting the technical market out look below for certain major instruments such as the USDX itself, EURUSD, XAUUSD, ES500. The next move of the markets might be decided purely based on CPI whether higher or lower. Sideways moves will be the result of a potential mixed CPI release. Check out as well our article in which we are explaining the different variations and possibilities at: US CPI Wednesday September 11th 2024 – What Traders Need To Know Ahead of The Release – OneRoyal Blog

USDX 4HR – As far as above 27.08.2024 & 06.09.2024 & CPI Higher On track towards the 103 area for a double correction higher – A lower CPI Could Impose Risks To The Downside & Challenges previous lows

EURUSD 4 HR Trendlines broken, Still On track For Deeper Correction towards the 0.5% – 0.618% Fib Retracements From 01.08.2024 With A Higher CPI – Otherwise 1.12000 Might Be Challenged

XAUUSD 4HR Sideways – Tendency for Potential Fake Outs – New High Still Possible – CPI Key For The Next Move – If Resistance from 20.08.2024 2532$ area remains Intact With A Higher CPI Reaction Towards 0.5% – 0.618% Fib Retracement Levels from 05.08.2024 Is Likely

ES500 Mini Futures – 4HR CPI To Determine The Next Move – Higher CPI = Lower – Lower CPI = Higher

As we can see most markets are looking for a breakout on either direction which it comes with anticipation of the CPI data and until then markets can remain choppy waiting for the data. We will be providing an update during the NY Session. Traders should keep in mind the different variations of the release and where markets are in terms of their technical levels to make better trading decisions ahead.

If you are new here and you do not already have a trading account you can sing up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.