Hello Traders,

We have reached the day that everyone has been anticipating as the US Federal Reserve will host the FOMC meeting at 19:00 GMT, in which they are expected to start cutting interest rates. The signal of a monetary policy shift was given officially on August 23rd during the Jackson’s Hole meeting by the Fed’s Chairman Jerome Powell.

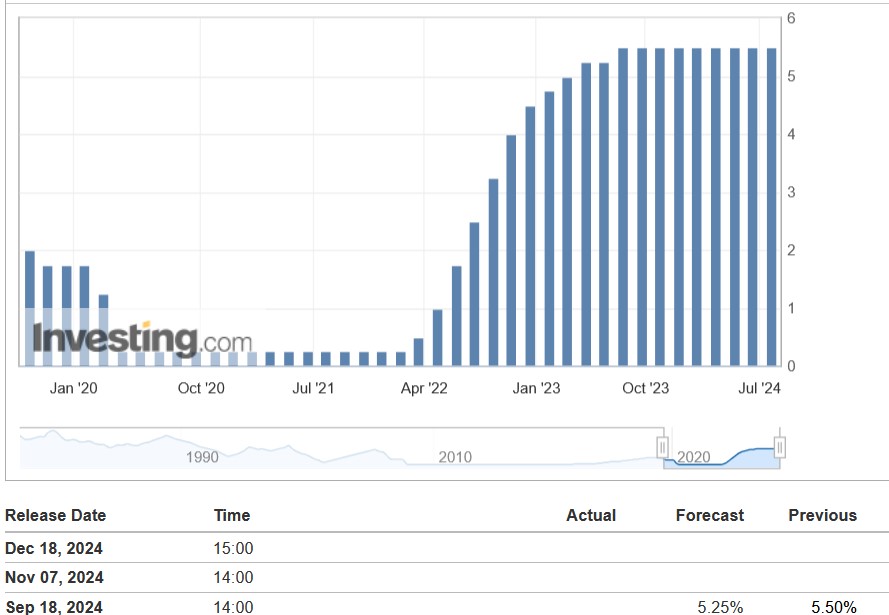

The decision of the monetary policy shift came after weaker US employment data has been seen over the summer as well as with combination of a reduction in US CPI Inflation coming back down towards 2.5%. As the current US interest rates are at 5.50%, the consensus by analysts are expecting a 25bps rate cut to bring it down to 5.25%, however is key to note that markets are expecting a 50bps rate cut. Analysts point of view is that the US economy overall has not seen yet any significant weakness for a bigger rate cut at this stage as well as the fact that by end of the year the total of 3 FOMC meetings can accommodate a total of 75bps rate cut of 25bps each.

Over the past year US interest Rates remained at 5.50% – Chart from investing.com

As we can see analysts forecast is a 25bps for this meeting while we will have another 2 meeting before the year ends with the next one scheduled just after the US presidential elections.

In the grand scheme of things, reduction of interest rates means a dovish monetary policy which boosts prices of assets across the board including precious metals, equities and depreciating the value of the currency. This has been the main market dynamic ever since Q4 2022 in what seems that markets have been expecting the shift of monetary policy as the US Economy has been recovering after the COVID 19 in 2020 and has been able to reduce the levels of inflation. The Federal Reserve now aims to gradually reduce the rates in order to avoid high borrowing costs so that the economy continues to provide more job and business opportunities and avoid being late and get into another recession.

As we head into this shift in policy and with US elections ahead of us, a big importance will be looking at the next NFP numbers, unemployment rates and CPI for clues as to where the economy will be heading towards. US Equities and main Indices such as the SPX & Dow Jones has been at all time highs in what seems to be a very strong bullish market since Q4 2022.

In the short term, as mentioned above markets expect a 50bps cut today but analysts consensus a 25bps cut. The possible impact to the markets if a 25bps will take place might produce adverse reaction to the markets causing the US Dollar Index to spike while metals, Indices and the stock market to react to the downside. A surprise with a higher cut of 50bps should provide more upside to the equities and a reaction lower to the USDX.

And lastly, the press conference just after the rate decision should be key in terms of hints from Jerome Powell in terms of how the Federal Reserve looks at the Economy and the future monetary policy adjustments, which they are expected to remain dovish overall. Traders should also pay attention to the market’s overall technical structures and pivots for the next possible reaction. A potential volatile session could be expected heading into the event and this week overall. You can read our weekly market outlook at: https://blog.oneroyal.com/blog/weekly-market-outlook-sep-16th-20th-2024-interest-rates-decision-week-ahead-fomc-boe-boj-in-focus/

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.