Hello Traders,

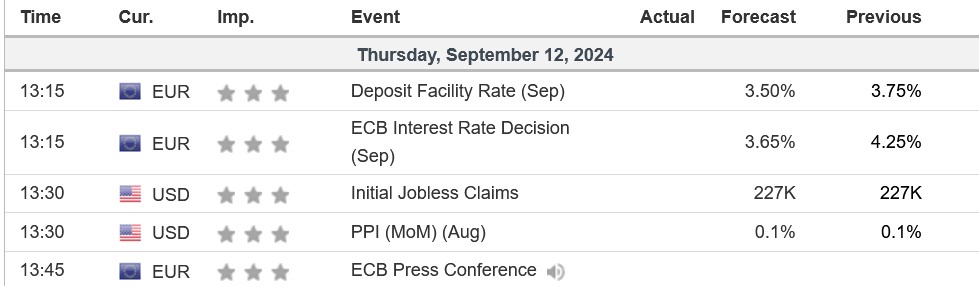

As we have gone through yesterday’s US CPI data, today the main focus is turned into ECB’s interest rate decision and US’s Jobless Claims & PPI data. Analysts expect that the ECB could potentially cut interest rates by 60 basis points from 4.25% down to 3.65%. Then 15 minutes later we will have the US PPI data. The rate cut for the Euro is a dovish stance thus potentially depreciating the value of the currency. However, if a smaller rate cut will be taken it could also provide a reaction higher in the EURUSD for example.

*Data Provided by investing.com

Traders need to be aware of potential volatility as we head into the releases and the NY Session as the news might counter act with each other creating indecision in term of the path for the EURUSD or US Dollar related pairs as well.

A higher than expected PPI and lower number of Jobless applications can send the USDX higher in value and with a combination of ECB’s interest rate cut the EURUSD might be the one to watch for for a potential move to the downside. Adverse reactions can happen if the data comes the other way. Check out our weekly market outlook and what we saw from the beginning of the week in terms of the markets overall technical analysis and pivot points at: https://blog.oneroyal.com/market-analysis/weekly-market-outlook-september-9th-13th-2024-all-about-us-cpi-ecb-interest-rate-ahead/

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.