Oracle and Tesla stocks achieve record gains.

The US indices closed with collective gains in Monday’s session, supported by the recovery of major stocks amid optimism about slowing inflation rates and interest rate stability this week.

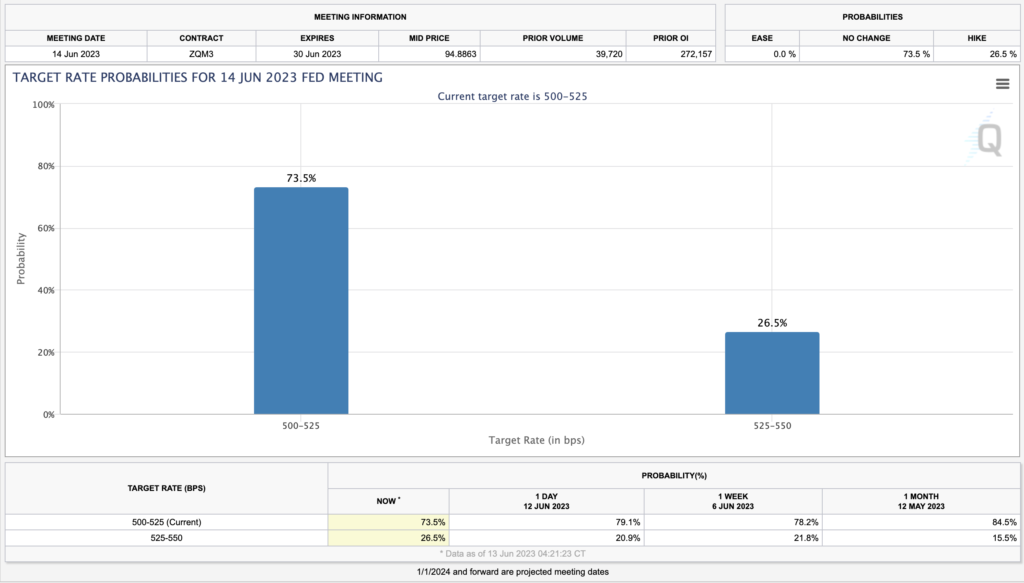

Traders perceive a 76% chance that the Federal Reserve will maintain interest rates within the 5% – 5.25% range on Wednesday.

Some investors also believe that Wall Street is in a bull market after the S&P 500 index rose by over 20% from its lowest levels in October 2022.

As for the major U.S. indices, the Dow Jones index rose by approximately 0.6%, equivalent to around 190 points on Monday, closing above the 34,000 point level for the first time since the beginning of May.

The S&P 500 index rose by about 0.9%, marking its highest close in about 14 months.

The Nasdaq Composite index also increased by approximately 1.5%, recording its third consecutive daily gain and highest close in about 14 months.

Oracle stock: Oracle stock rose by about 6%, hitting an all-time high and adding around $18 billion to its market value in a single day.

The company announced record quarterly results, with its revenues jumping by approximately 17% to $13.84 billion, surpassing analysts’ estimates of $13.74 billion.

JPMorgan also raised its target price before the fourth-quarter results later in the day.

Tesla stock: Tesla stock rose by about 2.2%, extending its gains for the 12th consecutive session and achieving its longest streak of daily gains in history.

On Monday, the company added around $17 billion to its market value, recording its highest close in over eight months.

Both General Motors and Tesla announced on Thursday that owners of General Motors’ electric vehicles would soon be able to use Tesla’s extensive fast-charging network.

This move comes after Tesla and Ford announced two weeks ago that starting next year, Tesla’s supercharger network in the United States and Canada will be open to Ford electric vehicles.

The Nikkei index surpasses 33,000 points for the first time since July 1990.

Japanese stocks experienced a strong surge in Tuesday’s trading session as the Nikkei index crossed the significant psychological level of 33,000 points for the first time since July 1990.

Stocks rallied, led by the semiconductor and automotive sectors, with Soft Bank shares rising by 5.25% and Mazda Motor shares increasing by 3.69%.

Toyota Motor’s stock jumped by 5.03% after the Japanese automaker announced its plans to develop a fully solid-state battery as part of its ambitious electric vehicle strategy.

The Nikkei index closed the session with a gain of 1.8% at 33,018 points, while the broader Topix index rose by 1.16% to reach 2,264 points, marking a new high for 2023.

The US dollar remained stable against the Japanese yen at 139.60 yen as of 08:25 GMT.

Gold rises ahead of the US Federal Reserve meeting and inflation data release.

Gold prices rose on Tuesday, June 13th, as the dollar weakened. However, price movements remained within a narrow range as market participants awaited the release of US inflation data later in the day and the Federal Reserve’s policy decision tomorrow.

Spot gold increased by 0.28% to $1,962.9 per ounce as of 08:32 GMT. US gold futures also rose by 0.42% to $1,977.60.

The dollar declined by 0.2%, making gold priced in the US currency more attractive to holders of other currencies.

According to the CME Group’s FedWatch tool, market participants expect a 73.5% chance that the Federal Reserve will keep interest rates unchanged, while 26.5% expect a 25-basis-point rate hike.

source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

The European Central Bank will announce its decision on interest rates on Thursday, and it is widely expected that they will raise rates by 25 basis points.

However, the Bank of Japan, which will announce its decision on Friday, is expected to continue its monetary easing policy.

Among other precious metals, silver rose by 0.62% to $24.20 per ounce in spot trading. Platinum increased by 0.4% to $996.00, and palladium rose by 0.9% to $1,336.00.

Disclaimer: This article is not investment advice or an investment recommendation and should not be considered as such. The information above is not an invitation to trade and it does not guarantee or predict future performance. The investor is solely responsible for the risk of their decisions. The analysis and commentary presented do not include any consideration of your personal investment objectives, financial circumstances, or needs.