Oil prices slightly declined amid ongoing demand concerns.

Oil prices slightly declined in Thursday’s trading session after rising by around 1% yesterday, as concerns about demand persist and US inventory data is evaluated.

A report released yesterday by the Energy Information Administration indicated a rise in gasoline inventories in the United States for the first time in five weeks. However, they remain below the five-year seasonal average.

Fatih Birol, the Executive Director of the International Energy Agency, emphasized the importance of China to the oil market and anticipated that the recent decision by OPEC+ could push oil prices higher.

Brent crude futures for August delivery decreased by 0.29% or 22 cents to $76.73 per barrel at 05:05 GMT.

Similarly, US crude futures for July delivery declined by 0.29% or 21 cents to $72.32 per barrel, following a 1.1% increase yesterday.

Gold prices rise supported by weak dollar performance.

Gold prices rose on Thursday, supported by a weak dollar, but the yellow metal hovered near the low levels reached in the previous session.

Investors await indications from the Federal Reserve after the Bank of Canada raised interest rates to the highest level in 22 years.

At 03:07 GMT, spot gold increased by 0.4% to $1,946.47 per ounce, following a 1% decline in the previous session.

US gold futures also rose by 0.1% to $1,961.00.

The Bank of Canada raised its overnight rate to the highest level in 22 years at 4.75% yesterday.

Markets and analysts immediately anticipated another increase next month to curb high inflation.

US Treasury Secretary Janet Yellen stated that the US economy is strong, supported by active consumer spending, but some areas are experiencing slowdowns. She added that she expects continued progress in reducing inflation over the next two years.

Dollar declines amid expectations of US and global interest rate hikes.

On Thursday, June 8th, the dollar declined despite receiving some support from rising US Treasury bond yields.

Traders are assessing the possibility of another interest rate hike by the US Federal Reserve, even if it refrains from doing so next week.

Expectations are increasing that US and global interest rates may experience further increases following the surprise rate hikes by the Bank of Canada and the Reserve Bank of Australia this week.

After a four-month pause, the Bank of Canada raised its overnight rate to the highest level in 22 years at 4.75% yesterday.

Meanwhile, the Reserve Bank of Australia increased interest rates by a quarter point to the highest level in 11 years on Tuesday, warning of further hikes in the future.

The Canadian dollar steadied in the latest trading at 1.3365 against the US dollar after reaching a one-month high at 1.3321 in the previous session.

The US dollar widely declined in early Asian trading, while the British pound rose by 0.08% to $1.2449.

The euro also increased by 0.08% to $1.0707.

Against the yen, the dollar decreased by 0.21% to 139.85, as the Japanese currency received support from data released today, Thursday, showing the country’s economy growing by 2.7% annually in the first quarter, significantly higher than the initial estimate of 1.6% growth.

The dollar index slightly declined to 104.02 but remained close to the two-month high reached last week as Treasury bond yields rose.

The yield on 10-year Treasury bonds reached 3.7914% after rising by about ten basis points, reaching a peak at 3.801% on Wednesday.

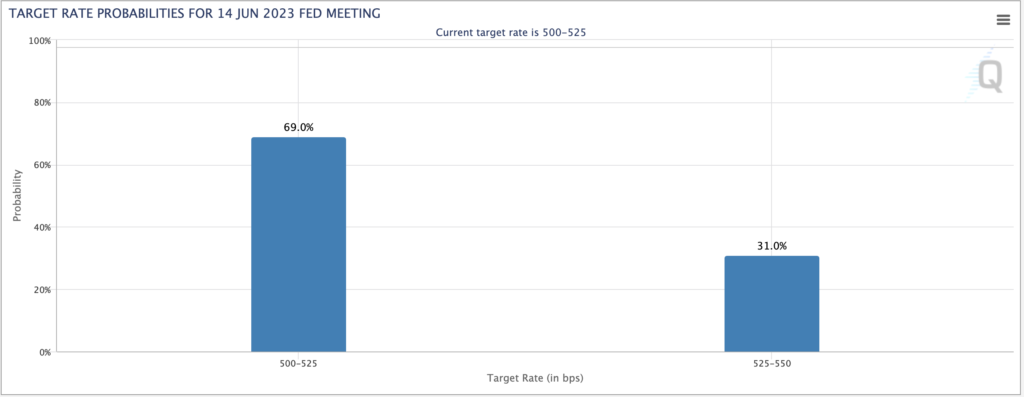

In the upcoming policy meeting, financial markets anticipate a 31.0% chance that the US Federal Reserve will raise interest rates by 25 basis points.

Source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

The Chinese yuan remained stable abroad near its lowest level in over six months at 7.1469 against the dollar, after falling to 7.1527 in the previous session, which was the lowest level since late November.

Data released yesterday, Wednesday, showed a much faster decline in China’s exports in May than expected, while imports continued to decrease, raising doubts about the country’s fragile economic recovery.

The Australian dollar rose by 0.18% to $0.6665, after declining by about 0.3% in the previous session.

Meanwhile, its New Zealand counterpart increased by 0.22% to $0.6050, recovering some of the losses recorded yesterday, which reached 0.7%.

The Turkish lira plummeted to a record low at 23.39 against the dollar.

Disclaimer: This article is not investment advice or an investment recommendation and should not be considered as such. The information above is not an invitation to trade and it does not guarantee or predict future performance. The investor is solely responsible for the risk of their decisions. The analysis and commentary presented do not include any consideration of your personal investment objectives, financial circumstances, or needs.