Japanese Stocks Closed High.

Japanese stocks closed higher on Friday, boosted by strong corporate earnings and local business expectations. Tokyo Electron is leading the gains after raising its annual profit forecast.

The Nikkei index rose 0.31% to close at 27,670.98 points after rising 0.8% earlier in the session. The index recorded a weekly gain of 0.59%. The Topix index gave up some of its revenues, closing only 0.1% higher at 1986.96 points. The index recorded weekly gains of 0.85%.

Tokyo Electron chip-making equipment rose 4.35% after the company raised its full-year operating profit forecast. The company’s stock has become the biggest supporter of the Nikkei index, while its peer Advantest rose 1.5%.

Kobe Steel jumped 14.97% to record the best performance on the Nikkei index after announcing a record dividend for the year. The steel industry index rose 3.4%, becoming the best-performing sector among the 33 industry sub-indices on the Tokyo Stock Exchange.

Dainippon Printing rose 13.81% after it announced its most significant share buyback. The real estate sector declined by 1.54%, affected by losses of Mitsubishi Real Estate and Mitsui Fudosan by 3.77% and 1.2%, respectively.

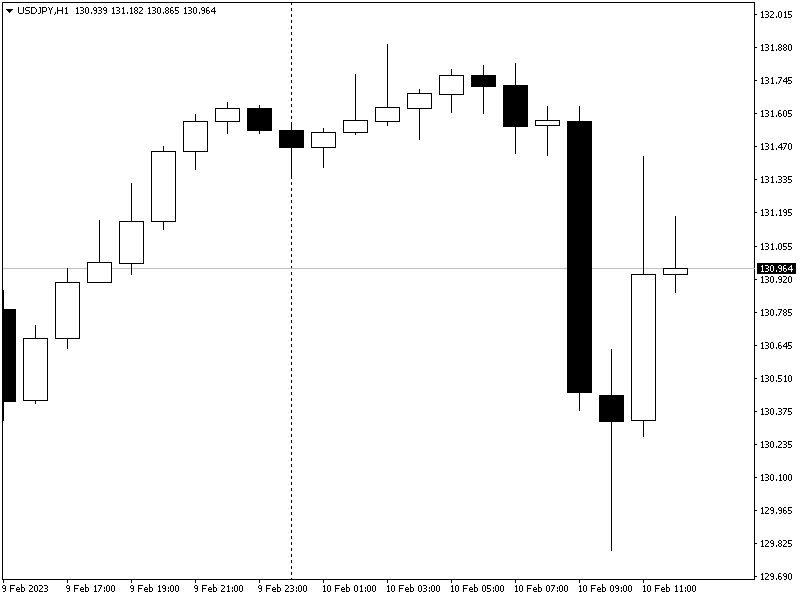

USD/JPY is Witnessing Volatile Movements

USD/JPY is undergoing volatile movements today. The currency pair reached 131.891 at 4:00 am MT4 time before dipping to 129.799. Then, the US dollar then regained its strength against the Japanese Yen. The couple then topped 131.427 before settling at the 130.960 level.

The strong movements were triggered by the report released by Japanese media today. The press stated that the government would appoint “Kazuo Ueda” as the next BOJ governor after seeing current deputy governor “Masayoshi Amamiya” firmly rejecting their approach to succeed Kuroda.

The Japanese government plans to present candidates for the posts of BOJ governor and two deputy governors to Parliament on February 14. Friday’s data showed that wholesale prices in Japan rose 9.5% year-on-year in January, adding to growing indications of inflationary factors that could keep the central bank under pressure to gradually abandon its broad stimulus program.

The Dollar is Heading to Close its Second Week of Gains.

The dollar rose broadly on Friday as investors remained risk-averse ahead of US inflation data next week. Concerns about an economic slowdown and the Federal Reserve’s interest rate hike have also affected sentiment.

The dollar index rose 0.155% to 103.34 after falling 0.24% in the previous session. The index is heading for a second consecutive week of gains, which it has not recorded since October. EUR/USD fell 0.15% to $1.072, heading for losses for the second week. The pound sterling fell against the US dollar in the latest transactions by 0.24% to 1.2093. The Australian dollar also fell 0.20% to $0.692, and the New Zealand dollar fell 0.24% to $0.631.

US Indices Fell after the Rise in US Yields.

US indices recorded a collective decline at the close of Thursday’s session, pressured by an increase in Treasury yields. The weak 30-year bond auction led to the loss of the positive momentum resulting from the positive financial results of Disney and PepsiCo. US Treasury bond yields rose to 3.73%, their highest level in about a month.

The Dow Jones index fell by 249 points to 33,699 points, the index’s worst session since the beginning of February. The financial sector topped the list of losers after declining by 1.3%. The Dow Jones Industrial Average touched the 50-day moving average levels and hovered around 33,650 before reducing its declines and closing slightly above it.

The S&P 500 index lost 4,100 points, down by 0.9% in Thursday’s session, to 4,081 points, amid a decline in all sectors. The Nasdaq Composite Index fell by 1%, recording the second consecutive daily decline at 11,789 points.

Disclaimer: This article is not investment advice or an investment recommendation and should not be considered as such. The information above is not an invitation to trade and it does not guarantee or predict future performance. The investor is solely responsible for the risk of their decisions. The analysis and commentary presented do not include any consideration of your personal investment objectives, financial circumstances, or needs.