Weekly Recap

The main story this week was the July FOMC minutes. Given the recent market focus on a potential Fed-pivot, traders were looking to the minutes to essentially reinforce this view or dilute it. Ultimately, the minutes added support for the USD, showing the Fed to be committed to continuing its tightening program, prioritizing its battle to return inflation to its 2% target.

Additionally, the Fed was seen welcoming recent USD strength for its role in driving own import inflation. However, the minutes did reveal some concern over the potential for tightening too aggressively and outlined plans to be data dependent in future rate adjustments. In light of the recent negative Q2 GDP print and weaker July CPI, these comments are expected to resonate in coming sessions.

Away from the Dollar, there were more noteworthy developments in markets this week. Negative consumer and industrial data out of China at the start of the week, along with an unscheduled rate cut from the PBoC has resharpened the focus on a potential slowdown in China. With risks of further lockdowns in the near-term, the outlook is darkening over the remainder of the year.

UK CPI hit fresh 40-year highs of 10.1% in July, turning attention back to BOE rate-hike expectations. The market quickly adjusted its pricing for rates over the next year, now expected to peak around 3.4% from around 2.9% in July.

In the eurozone, weaker than expected flash GDP for Q2 has added to bearish sentiment there on the back of recent data weakness in Germany. With investors anticipating a coming slowdown in the single market, clouds are gathering over European assets with EURUSD testing 1.01 and again poised to hit parity.

Finally, the RBNZ hiked rates by a further 50bps and signalled the need to continue with aggressive tightening in a bid to combat soaring inflation. NZD was broadly weaker on the back of the event as markets focused on the growth implications of further tightening and the expected continued slide in NZ house prices.

Coming Up This Week

- US, UK & Eurozone PMIs

The next set of PMI data sets will be closely watched given the rising fears around a potential global recession this year. The impact of surging inflation, COVID disruptions and supply constraints is expected to impact both factory and non-factory sectors alike. In particular, traders will be looking to see how the eurozone performs given the specific impact of the ongoing Russia-Ukraine war.

- US Durable goods, prelim GDP & core PCE

A swathe of key US data has the potential to create plenty of USD volatility this week. On the back of recent data weakness and the FOMC minutes last week, this week’s data has the potential to be a turning point for the Dollar as traders look ahead to the September FOMC. Further weakness is likely to put the emphasis on the Fed’s data dependant outlook for rates, raising the chances of a softer hike in September. Meanwhile, any surprise strength should skew expectations back towards a larger 75bps hike.

- Jackson Hole symposium

The Jackson Hole symposium this week couldn’t be timed any better. Given the hawkishness of the Fed’s outlook in July, versus the negative GDP print and weaker inflation print we’ve seen since then, this will be a prime opportunity for the market to gain greater insight into the Fed’s near-term outlook and assessment. Given how wrong Powell’s outlook proved to be last time around, it will be interesting to see how the Fed chairman decides to address those previous assessments and forecasts alongside offering fresh guidance this time around.

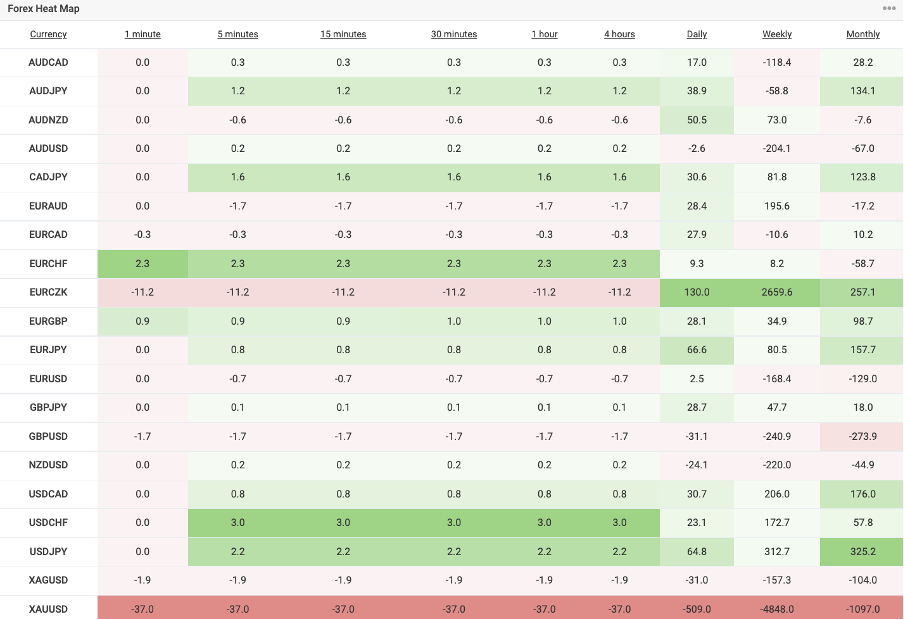

Forex Heat Map

Technical Analysis

Our favourite technical chart of the week – GBPUSD

The recent bounce off the 1.1760 level has seen the market trading back up to retest resistance at 1.2159. This level is holding for now and recent price action shows plenty of selling interest at and above the level.

While we hold below, expect a further rotation lower within the longer-term downtrend looking for a break of the 1.1760 lows towards the 1.1414 level. Only a firm breach above the 1.2159 level will negate this view.

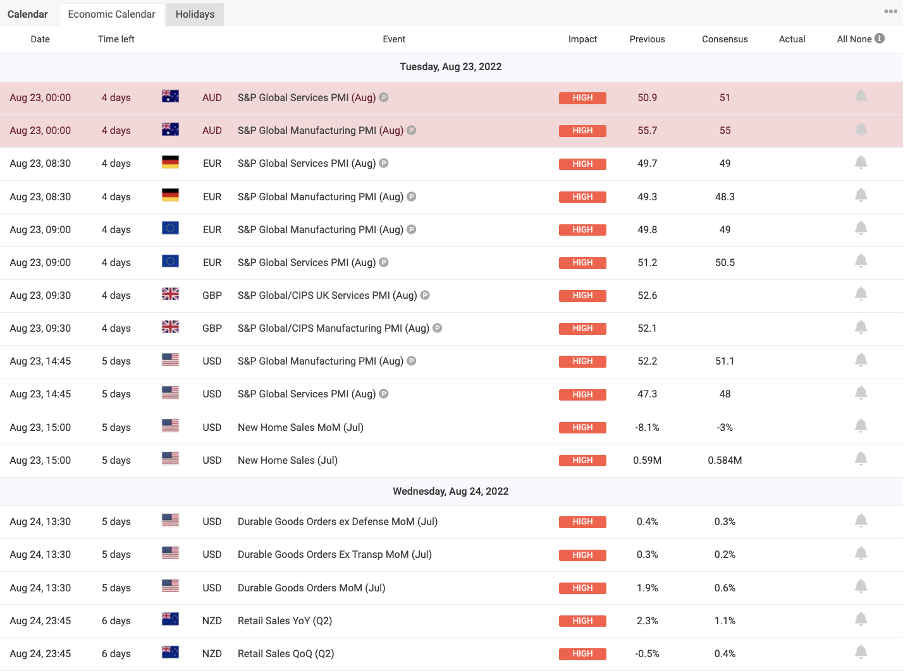

Economic Calendar

Plenty to keep an eye on this week data-wise, with the latest round of PMI releases in the US, UK and Eurozone among other key events and releases. See the calendar below for the full schedule.

Disclaimer: This article is not investment advice or an investment recommendation and should not be considered as such. The information above is not an invitation to trade and it does not guarantee or predict future performance. The investor is solely responsible for the risk of their decisions. The analysis and commentary presented do not include any consideration of your personal investment objectives, financial circumstances, or needs.