Hello Traders,

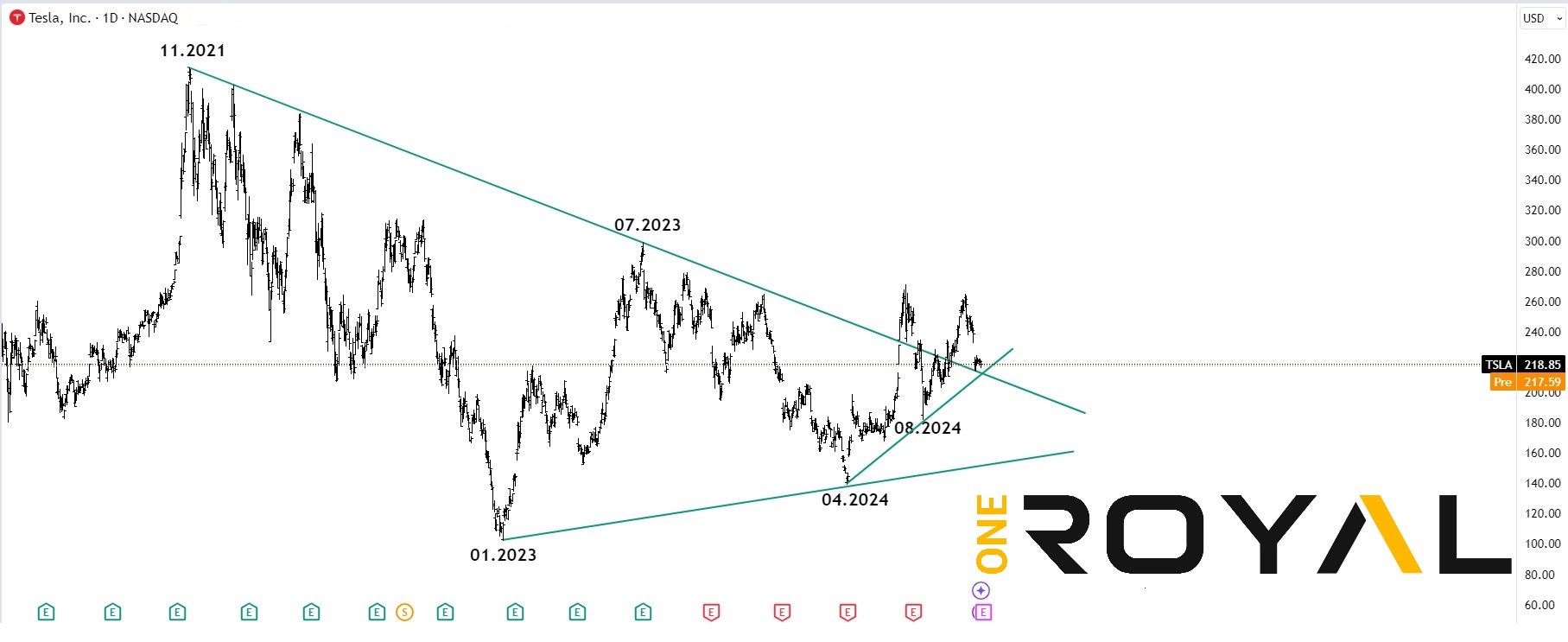

Tesla Inc. shares (TSLA) managed to break out from a 3 year downwards trendline after the all time cycle peak from November 2021 around the $414 mark. However, since July this year and the $270.85 2024’s peak prices failed to continue any positive moment and fell back to the $218 area in a potential trendline retest ahead of Tesla’s quarterly earnings release, due tomorrow after the market close. In the previous quarter, Tesla’s earnings per share were reported at $0.52 with sales of $25.5 billion, missing Wall Street’s expectations of $0.61 per share and $24.5 billion in sales.

Current estimates from analysts suggest that Tesla’s third-quarter earnings will be around $0.59 per share with sales reaching $25.4 billion, compared to last year’s $0.66 per share and $23.4 billion in sales. Tesla delivered approximately 463,000 vehicles in the third quarter, surpassing the previous year’s 435,000. Despite an improved operating margin at 7.6% compared to 6.3% in the previous quarter, challenges such as slower sales growth, high Cybertruck production costs, and increased incentives have impacted Tesla’s profitability. Improving these margins is critical, with Wall Street projecting an 8% operating margin for next year.

TSLA Daily Time Frame – Trendline Break & Retest?

As long as the earnings estimates are in line with forecasts or higher, buyers could potentially manage to send prices higher and aim for the $260+ area and retest July’s highs. Otherwise, a break lower could expose the $180 area where the August lows can be seen.

TSLA 4HR – Earnings Likely To Determine The Next Move

Investors, should anticipate to hear any further news in terms of upcoming projects from Tesla’s CEO Elon Musk, other than the earnings report and look for any potential hints to the future developments of the company. Can the company break away from the 4 negative previous earnings reports? The answers should be provided on Thursday, October 23rd after the stock market close. Traders, should consider the above mentioned pivots and levels when taking any trading decisions and follow their risk management principles, as we could be seeing a bigger reaction ahead.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.