Caution dominates the US markets before the Federal Reserve meeting, and the First Republic Bank’s deal boosts JPMorgan’s stock.

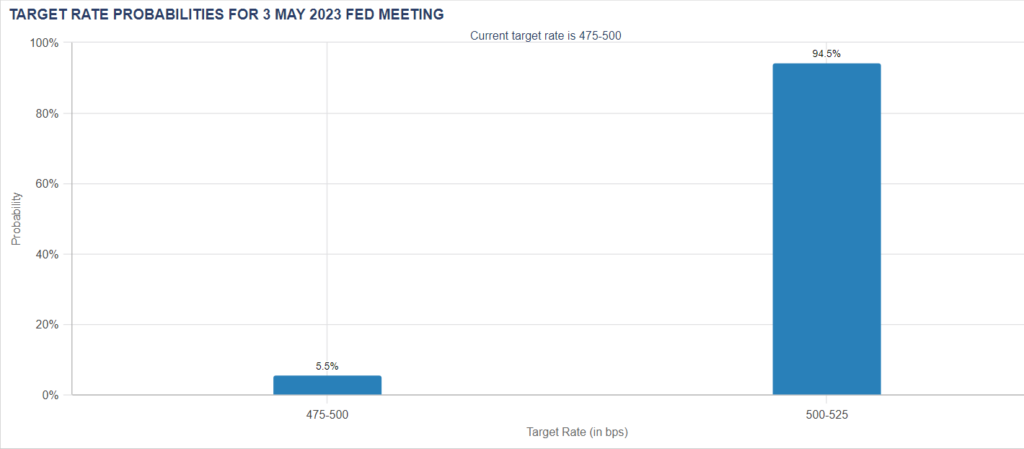

The US indices closed with slight changes in the first session of May as investors remain cautious ahead of the Fed’s decision this week, in addition to developments in the First Republic bank crisis. FED WATCH data showed the markets’ expectations for a 25-basis-point interest rate hike to 94.5%.

The S&P 500 index fell 0.05% to close at 4,167.3 points, while the Nasdaq Composite Index lost 14.83 points, or 0.12%, to close at 12,212 points. The Dow Jones index dropped 46 points, or 0.14%, to 34,051 points, dropping from its highest levels in two months.

JPMorgan’s stock rose to its highest level in two months after announcing that it would pay the US Federal Deposit Insurance Corporation $10.6 billion to control most of First Republic Bank’s assets.

“Jamie Dimon,” CEO of JPMorgan Chase, stated that the crisis that led to the collapse of three US regional banks in recent weeks has primarily ended after the bank purchased First Republic.

Under the deal, JP Morgan will obtain $104 billion in deposits in the First Republic and purchase assets worth $229 billion out of $233 billion recorded in the first quarter of 2023.

The Japanese yen fell to its lowest level against the euro in 15 years.

Its sharp decline continued on Tuesday, amid the ongoing impact of the Bank of Japan’s commitment to monetary easing, days after its decision.

Meanwhile, the Australian dollar jumped to its highest level a week after the Reserve Bank of Australia unexpectedly raised interest rates, indicating that the coming period may see further monetary tightening.

The bank raised the interest rate to 3.85% and said further tightening may be needed to ensure that inflation returns to the targeted level within a reasonable timeframe.

The Australian currency rose 1% to just under 67 US cents for the first time since April 25, after hovering around 66 cents for most of last week.

The euro advanced 0.24% to 151.31 yen, its highest level since September 2008.

The dollar rose 0.21% to 137.74 yen for the first time since March 8. If it surpasses the 137.90 level, it will be its highest level this year.

The euro gained 0.1% against the dollar to $1.0985 but remains near its lowest levels of last week.

Gold prices stabilize amid caution ahead of the US Federal Reserve meeting.

Gold prices remained stable on Tuesday as traders awaited new signals from major central banks regarding their monetary policy plans, especially the US Federal Reserve.

There was little change in spot gold, which traded at $1,983.29 per ounce by 05:28 GMT, while US gold futures fell 0.1% to $1,991.

Ajay Kedia, a member of the board of directors of Kedia Commodity in Mumbai, said that gold prices could move towards the $2,000 level if the Federal Reserve highlights concerns about a recession and hints at a temporary pause in the interest rate hike cycle.

It is also likely that the European Central Bank will raise interest rates for the seventh consecutive time at a meeting on Thursday.

As for other precious metals, spot silver fell 0.4% to $24.87 per ounce. Platinum fell 0.1% to $1,048.34, while palladium rose 1% to $1,466.36.

Disclaimer: This article is not investment advice or an investment recommendation and should not be considered as such. The information above is not an invitation to trade and it does not guarantee or predict future performance. The investor is solely responsible for the risk of their decisions. The analysis and commentary presented do not include any consideration of your personal investment objectives, financial circumstances, or needs.