“Debt Ceiling” Approved by the US House of Representatives

The US House of Representatives approved legislation to limit the debt, crafted by President Joe Biden and House Speaker Kevin McCarthy, that would impose restrictions on government spending during the 2024 elections and avoid default in the unstable United States.

Lawmakers from both parties joined in approving the bill with a vote of 314-117 on Wednesday evening, sending the measure to the Senate for consideration as the virtual deadline approaches.

The vote strengthens Biden’s reputation for bipartisanship and cross-party work as he seeks a second term and allows McCarthy to claim success in his first major test as speaker.

The debt ceiling legislation will remove the threat of another default crisis for the remaining period of Biden’s current term, as the debt limit will be suspended until January 1, 2025.

In return, Democrats agreed to set a maximum level of federal spending until 2025, likely resulting in reduced services provided by the government.

Crude oil prices rose, supported by the approval of the debt ceiling bill by the US House of Representatives.

The prices rebounded after two consecutive sessions of decline, driven by the passage of the debt ceiling bill by the US House of Representatives, which prevents the country from defaulting and has been forwarded to the Senate.

In addition, a survey showed a slight expansion in manufacturing activity in China in May, which was a surprising improvement contrary to the official data released yesterday indicating a contraction in activity.

Estimates from the American Petroleum Institute released last night indicated a 5.2 million barrel increase in crude oil inventories in the past week. If confirmed by today’s official data, it would be the largest inventory increase since February.

Brent crude futures for August delivery rose by 0.55% to $73 per barrel at 05:02 GMT.

US crude futures for July delivery also increased by 0.46% or 31 cents to $68.40 per barrel, following a decline of about 6% in the past two sessions.

Nvidia shares lost $56 billion in a single session, while Intel shares reached their highest level in 6 weeks.

US indices closed lower in Wednesday’s session amid speculation about a deal to raise the debt ceiling with a crucial vote in Congress. Strong labor market data raised concerns among investors about the Federal Reserve raising interest rates again in June.

The Department of Labor reported that job opportunities in the United States unexpectedly increased in April, indicating continued strength in the labor market.

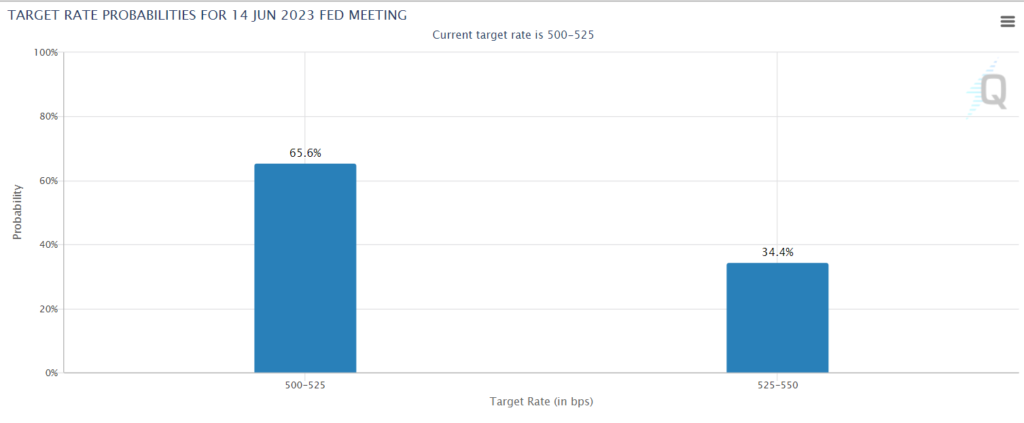

However, data from Fedwatch indicated that the likelihood of a 25 basis point interest rate hike decreased to 34.4% after statements from Federal Reserve officials expressed their desire to pause interest rate hikes at the upcoming meeting.

source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

Performance of major US indices:

In Wednesday’s session, the Dow Jones Industrial Average (DJIA) declined by approximately 0.4%, or 134 points, closing near its lowest levels in two months.

Over the month, the DJIA decreased by around 3.5%, marking its second monthly decline in 2023.

The S&P 500 index declined by about 0.6% in Wednesday’s session but maintained monthly gains of about 0.25%, increasing for the third consecutive month.

The Nasdaq Composite index also declined by approximately 0.6% but maintained monthly gains of about 5.8%, achieving an increase for the third consecutive month and the highest monthly close since March 2022.

Nvidia stock: Nvidia shares declined by 5.7% in Wednesday’s session, marking its largest daily loss in 4 months after reaching its all-time high in the previous session and entering the trillion-dollar club.

The company’s market value lost around $56 billion in this session, decreasing to $943 billion.

The momentum on Nvidia’s stock began after the company forecasted an increase in demand for its artificial intelligence chips, which power ChatGPT and other applications.

Intel stock: Intel shares jumped by 4.8% in Wednesday’s session, recording its third daily increase and the highest daily close in 6 weeks.

This momentum on the stock came after the chip manufacturing company stated that it was on track to meet the upper end of revenue expectations for the second quarter.

Disclaimer: This article is not investment advice or an investment recommendation and should not be considered as such. The information above is not an invitation to trade and it does not guarantee or predict future performance. The investor is solely responsible for the risk of their decisions. The analysis and commentary presented do not include any consideration of your personal investment objectives, financial circumstances, or needs.