Weekly Recap

It was a tale of two halves for the US Dollar this week. The greenback was initially seen trading higher in response to Tuesday’s bumper US inflation report for August. Both core and headline CPI readings came in above forecasts, confirming a fresh jump in inflation. The data saw market pricing for the September FOMC swinging in favour of a larger hike with traders pricing in a 75bps hike and attaching a circa 30% likelihood to a larger 100bps increase.

However, later in the week, the USD rally was blunted by a set of weaker-than-expected US retail sales for August. With a core reading of -0.3%, the focus turned back to the slowdown risks facing the economy and September FOMC pricing for a larger 100bps hike was seen falling by around a third.

Tuesday’s US inflation data showed that inflation is far from peaking and equities markets around the globe went cratering lower. The risk-off tone held over the bank end of the week as recessionary fears reared their heads. Central bank tightening and excessive inflation are keeping the global economy firmly squeezed with little sign of release in the near term.

The risk-off tone extended to commodities prices this week with gold and silver turning sharply lower over the week as the Dollar climbed again. Gold prices were seen bearing the brunt of the move with gold futures breaking down to fresh 2022 lows. Oil prices came under pressure too. Concerns over the global demand outlook amidst budding recessionary fears saw crude futures turning heavily lower into the back-end of the week.

In FX, along with USD strength, JPY was the big winner this week. A fresh wave of safe-haven demand helped drive support for the currency. JPY was also bolstered by news of the BOJ conducting a price check in the markets, said to be a precursor to intervention to help prevent further declines in JPY.

On the other side of the coin, risk currencies were sent lower this week along with GBP which saw the weakest performance of the week. UK inflation was shown to have remained near-record highs in August which, along with UK retail sales recording their largest drop of the year last month, has put the focus back on recession fears in the UK, driving GBPUSD to a fresh 47-year low.

Coming Up This Week

- September FOMC

The all-important September FOMC meeting will be the headline data event of the week. Traders are now fully pricing in a 75bps hike from the Fed on the back of the August CPI report. While CPI was shown to have cooled again annually, the monthly readings were both above forecasts, reinforcing the near-term need for the Fed to push ahead with further tightening. Focus, however, will be on the Fed’s guidance. If there is any hint that the Fed has turned less hawkish on next year’s guidance, this could easily pressure USD once more.

- September BOE meeting

Following the Fed, the BOE will step into the limelight on Thursday. While the latest UK inflation report showed that CPI had softened last month (9.9% from 10.1% prior), CPI is still at highly elevated levels and the BOE is widely expected to announce at least a further 50bps worth of tightening. Traders will also be keen to hear how the BOE assesses the new PM’s fiscal measures announced last week with a view to how the central bank thinks inflation will be impacted.

- US, EU and UK PMIs

Finally, on Friday traders will see the latest round of PMI readings for the three economies. Given the global growth concerns as we head into the final months of the year, PMI data sets will be closely watched. Last month saw widespread weakness with many of the readings seen plunging further into negative territory, reflecting the drop in activity. If these moves are seen extending this time around, risk sentiment is likely to suffer sharply.

Note: It’s a UK bank holiday on Monday so UK equity markets will be closed and trading in GBP could be more muted.

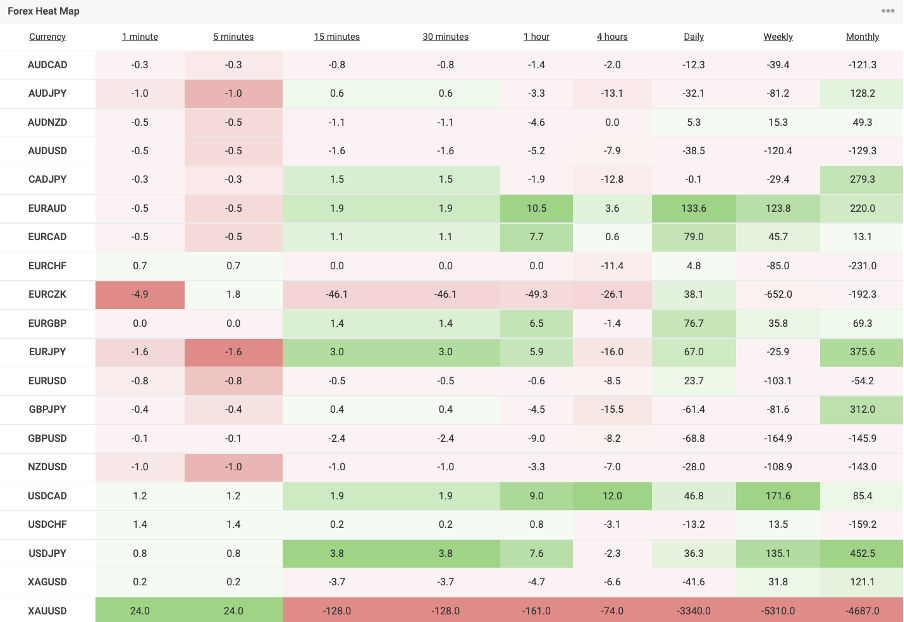

Forex Heat Map

Technical Analysis

Our favourite technical chart of the week – CADCHF

The reversal lower in CADCHF has seen the market breaking under 0.7498 (0.75) support and back down below the rising trend line from 2020 lows. Price is also testing below the last swing low at 0.7287. While price holds below this level, look for a continuation down towards the 0.7098 support area next.

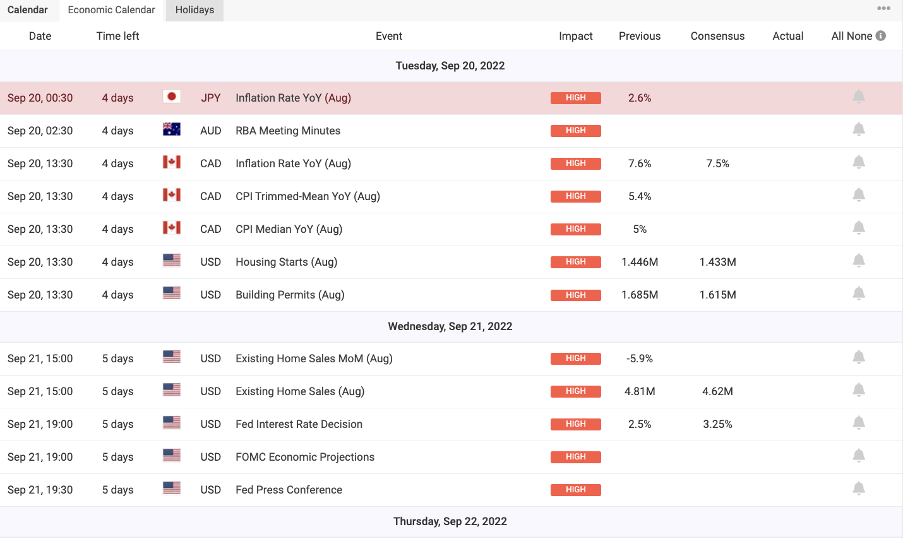

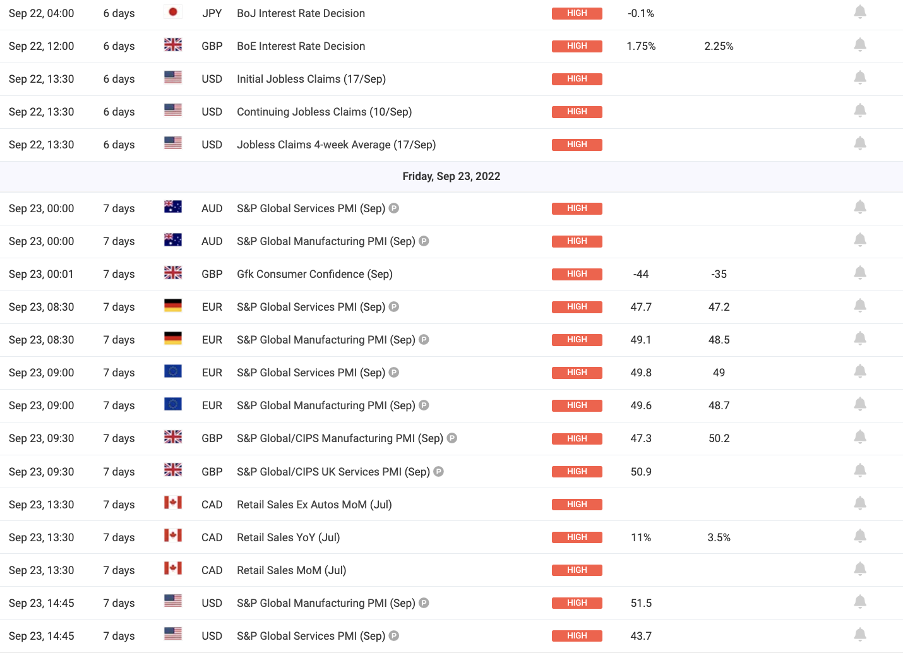

Economic Calendar

Plenty to keep an eye on this week data-wise, with the September Fed and BOE meetings as well as the latest PMI releases from the US, EU and UK among other key events and releases. See the calendar below for the full schedule.

Disclaimer: This article is not investment advice or an investment recommendation and should not be considered as such. The information above is not an invitation to trade and it does not guarantee or predict future performance. The investor is solely responsible for the risk of their decisions. The analysis and commentary presented do not include any consideration of your personal investment objectives, financial circumstances, or needs.