Hello Traders,

In this article we will be providing key insights in relation to the upcoming US CPI release for this upcoming Wednesday 11th of September at 13:30 GMT. CPI stands for Consumer Price Index, and it measures the overall change in consumer prices based on a representative basket of goods and services over time. In essence it measures how much in % terms Inflation overall has been impacting for higher prices for consumers in a specified economy.

The US CPI, if missed by a bigger margin from analysts forecasts can potentially cause volatility in markets such as the US Dollar Index itself and counter trading dollar pairs, as well as US Indices, stock markets, metals and commodities and it is important to be aware of the potential impact.

How markets react to higher or lower CPI levels?

In general, a higher than expected CPI release provides bullish momentum for the US Dollar and the market dynamic reacts in fear in relation to the stock market and US Indices which they tend to provide with a move to the downside. As we measure the value of metals and commodities in US Dollars, they also tend to react inverse to the USDX which when it rises from a higher CPI they tend to react lower.

A lower than expected CPI or in line with analysts forecasts can have the opposite effect with the above and thus create a reaction lower in the US Dollar and a reaction higher across the stock market, Indices and metals like Gold & Silver.

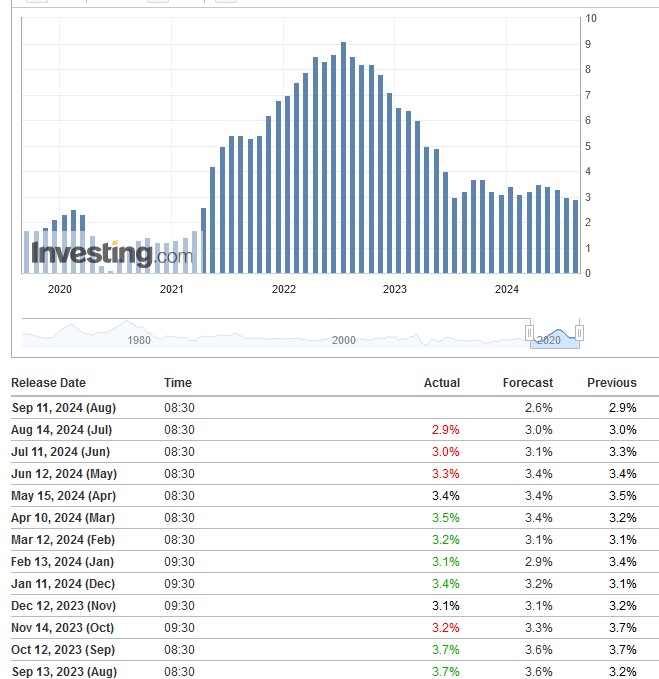

US CPI History Table Provided by investing.com

As we can see for this CPI analysts are expecting a 2.6% coming down from the previous of 2.9%. Over the last 2 years overall CPI has dropped significantly as seen from the histogram table above. As it has been seen across markets with stock markets around the world rising and metals such as Gold trading higher a lower CPI boosts confidence in markets overall. In the short term, a spike in CPI can potentially cause fear and thus why the USDX can spike while Equities, stock markets and metals like Gold tend to react lower in such scenarios.

We will highlight below from the US Dollar index chart previous scenarios from US CPI releases and showcase the market reactions. It’s important to understand that the following cases do not have to repeat or be the same in the future as markets sometimes, if they consider that they are priced in correctly they can also have the adverse effects. We will also explain the technical analysis in the USDX.

As we have highlighted from this week’s market outlook (Weekly Market Outlook – September 9th – 13th 2024 – All About US CPI, ECB Interest Rate Ahead – OneRoyal Blog ) following NFP’s release last Friday, the USDX as far as it hold above the 4hr pivot low of 100.515 from 27.08.2024 could potentially see the double correction higher to correct the decline from 26.06.2024, provided that a higher than the forecast CPI could be released. In a scenario where a lower than expected or as expected release comes out, then it is possible for the USDX to react even lower and thus the potential double correction higher could become less probable.

Having said that, traders need to be aware of the above information ahead of the release for tomorrow and make well informed trading decisions. We will publish tomorrow morning a market outlook before the release for a couple of major key instruments to watch for.

Hopefully you have found this article useful and educational. If you are new here and you do not already have a trading account you can sing up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.