Hello Traders,

As we are heading into this week’s market close with US PCE data remains to be announced here’s what we have seen this week thus far. With lower US consumer data early this week US equities recovered as we have seen US GDP at 3% as well as lower Jobless claims. On the other hand SNB’s 0.25% interest rate cut might impose signs of weakness in the CHF near term.

Gold has extended it’s gains early this week and now the focus should be shifting towards today’s PCE data and next week’s NFP. A higher than expected PCE today can cause a spike in US Dollar while metals to get weaker as well as Indices and stocks can be affected negatively as well. Anything below the forecast of 2.7% can support to maintain the current market dynamic which we had during the week.

Traders, should have in mind as well next week’s NFP as we are for a new month and volatility can come back in the markets. Let’s see the technical side of the US Dollar and relevant instruments.

USDX 4 HR – Closing Above 27.08.2024 & 18.09.2024 – Bias For A Potential Bounce Remains Intact

USDCHF – Will The 0.25% Rate Cut Weakens The CHF? – PCE Today & Next Week’s NFP Might Be Key

XAUUSD 4HR- Will The Momentum Divergence Hold & Produce A Pullback Towards The Trendline? PCE & NFP Are Key

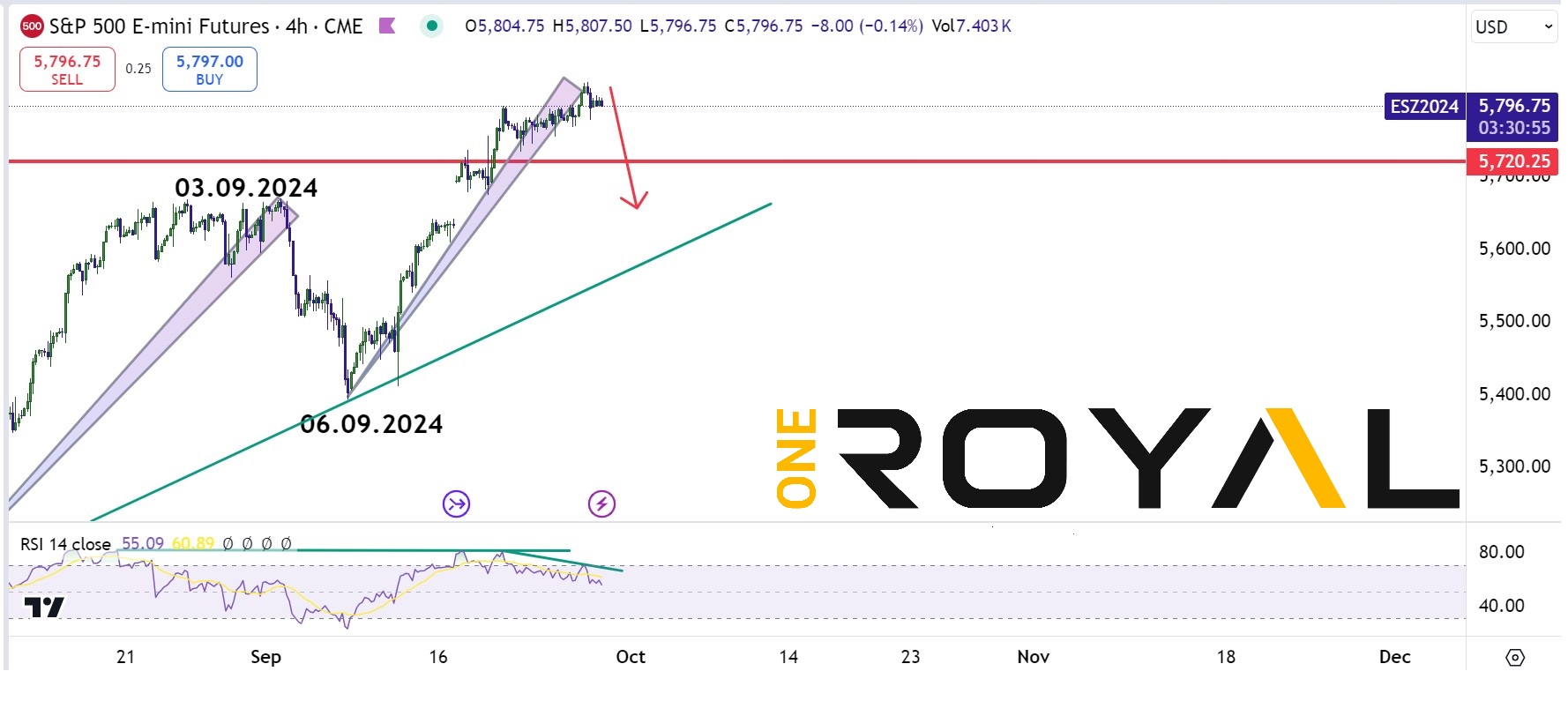

ES500 Mini Futures – 4HR After New Contract & ATH – RSI Divergence Might Send A Warning Short Term For Buyers

As we have mentioned above today’s PCE data and next week’s NFP should be key to determine how markets will be reacting while keeping in mind the market’s technical indications and pivot points. We will be providing early on Monday the next week’s outlook.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.