Hello Traders,

As we approach the end of September and entering into October and Q4 of 2024, the markets are on edge looking for the next reaction to take place with the main focus this week the jobs data from US. During the last week we have seen an overall choppy market and the US Dollar remained sideways to lower. This week should be key as we are entering into a new month with market anticipating the NFP & unemployment data from US to determine whether US Fed’s words of a soft landing and not a hard landing recession should be in the process as the monetary policy has already shifted with interest rate cuts underway. Today’s Powell’s speech might provide with some hints as to how the Fed see’s the current state of economy and monetary policy.

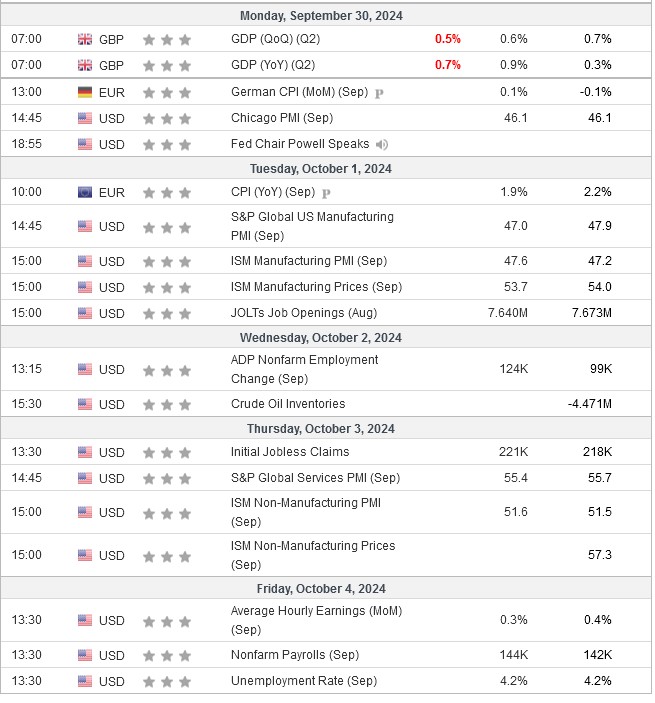

Week’s High Impact News September 30th – October 4th 2024 In GMT – UK’s GDP Released Lower

As seen UK’s GDP data released lower than expectations as we head into Germany’s CPI before EU’s CPI the day after. The main data markets anticipate this week is US data and most importantly the Job’s related data. Analysts do not expect any significant shifts vs the previous month’s data however any positive or negative surprises here are highly likely to affect markets and cause volatility. Let’s review the main major instruments and what their technical outlook might be hinting for the week according to current data.

USDX – 4HR Cycle from 26.06.2024 appears to be losing some momentum as RSI Divergence remains intact while price action creates a wedge looking for a decision this week. Bearish outlook can only resume with a decisive break lower followed by more negative US data, otherwise bulls might be able to create at least a reaction higher.

EURUSD 4HR – Decision Week For A Breakout- US Data To Determine The Next Move – Bulls Lose Slight Momentum But So Far Holding 11.09.2024

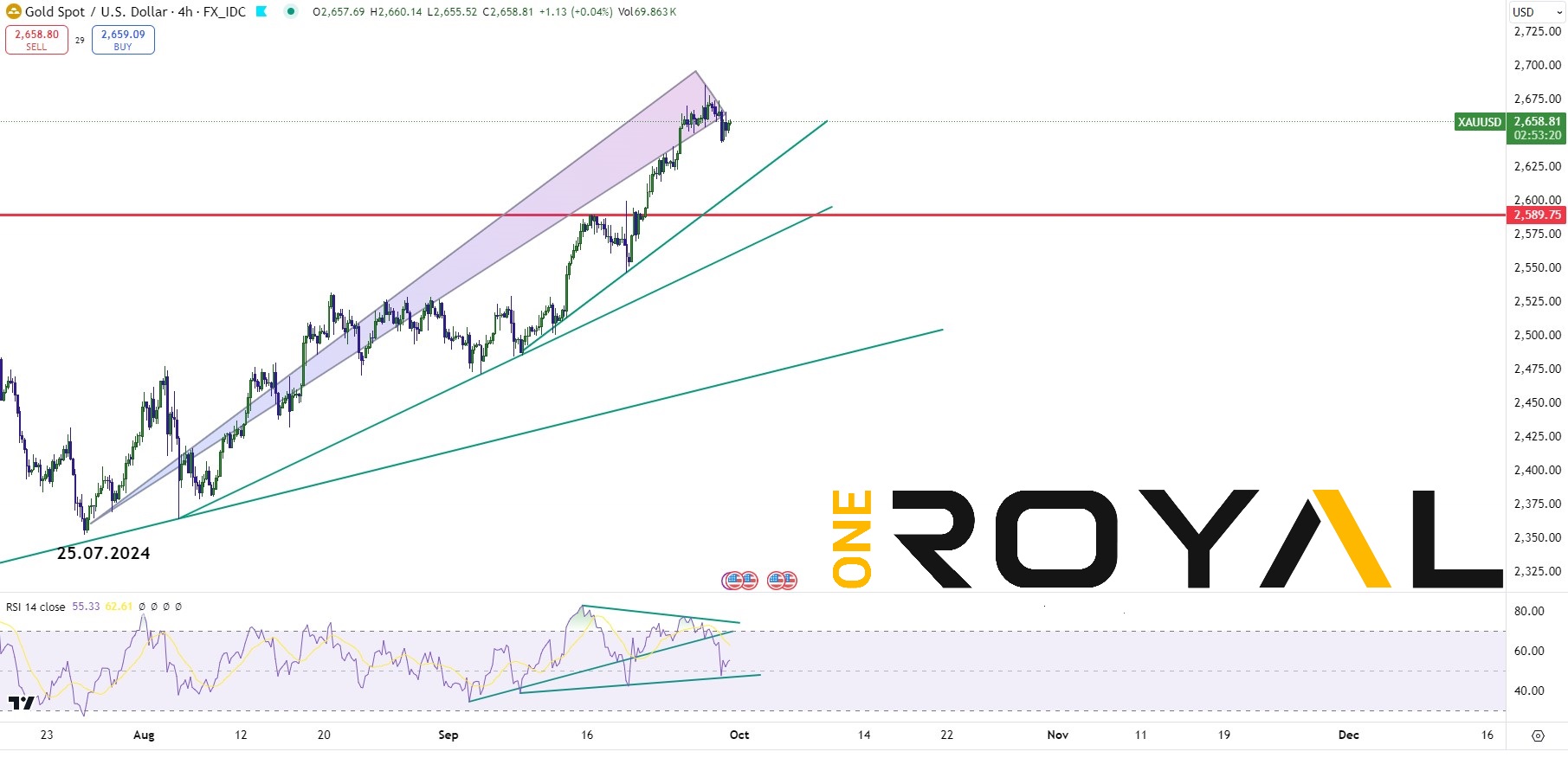

XAUUSD 4 HR – Cycle from 25.07.2024 Still In Process As Pullbacks Continue To Find Support – US Jobs Data Key To Determine Whether Trend Remains Intact This Week

ES500 Mini Futures 4 HR – Cycle From 05.08.2024 Main One Remains Intact – Secondary Cycle From 06.09.2024 Also Remains Intact As Of Now After New All Time Highs

As seen overall from the main key instruments, the markets are waiting for a definition this week with US data on the way. With the current market data we can overall see that the Cycle from 26.06.2024 in the US Dollar weakness lower is kind of stalling with some loss of momentum as the markets anticipate the data. After Inflation has cool off the main focus in markets now are shifted towards the jobs data to determine whether a major recession might be approaching or whether Fed’s soft landing expectations should be met. Traders should follow up with all important news this week in order to make better trading decisions.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.