Hello Traders,

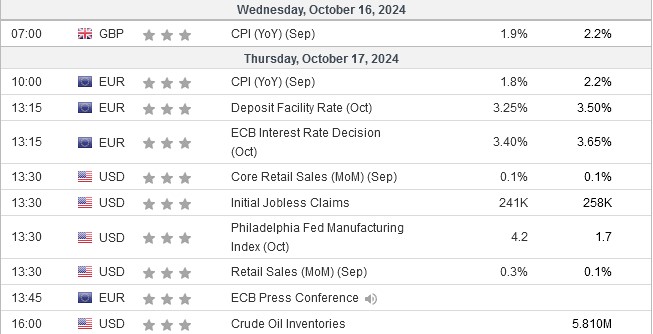

Heading into the 3rd week of the month, which starts more quite, the main focus is turned into Thursday whereby the ECB’s interest rate decision takes place, with EU’s CPI being released before the rate decision and US retail sales, Jobless claims & the Philadelphia Fed’s Manufacturing Index will be next. A day earlier UK’s CPI will be released. Last week, we have seen the US CPI coming down slightly overall while a spike in jobless claims and lower PPI. With the data being weaker for the US Dollar the market hasn’t really reacted yet and the focus should be turned into this week.

The ECB is expected to cut interest rates by 25 bps, from 3.65% to 3.40%, while US retails sales are expected slightly higher vs the previous month as well as the Philadelphia Fed Manufacturing Index expected higher than last month’s

Key Economic Data For The Week Ahead (Source: investing.com)

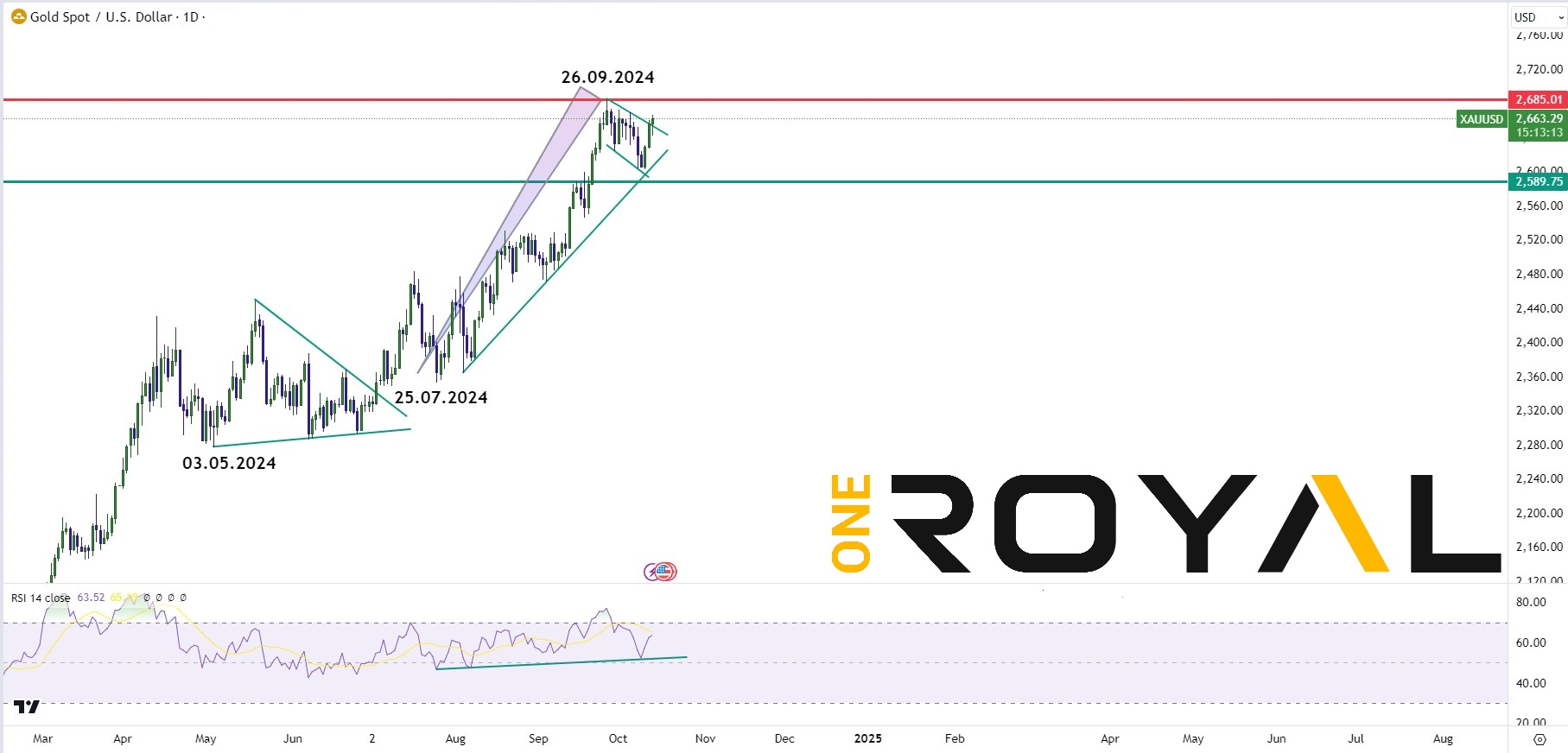

After the positive outlook in the US jobs market we have seen the US Dollar having a recovery bounce from the summer’s decline but the market will not be anticipating the next data ahead to determine the potential sustainability of that move. Last week’s spike in US Jobless Claims should be at least a small warning to be looking out for the upcoming jobless claims data before next month’s Nonfarm Payrolls data. As with all the uncertainty and recent war escalation developments in the middle east Gold continues to find support from buyer with any small dips along the way as the trend continues to be extremely strong within this year from February’s lows.

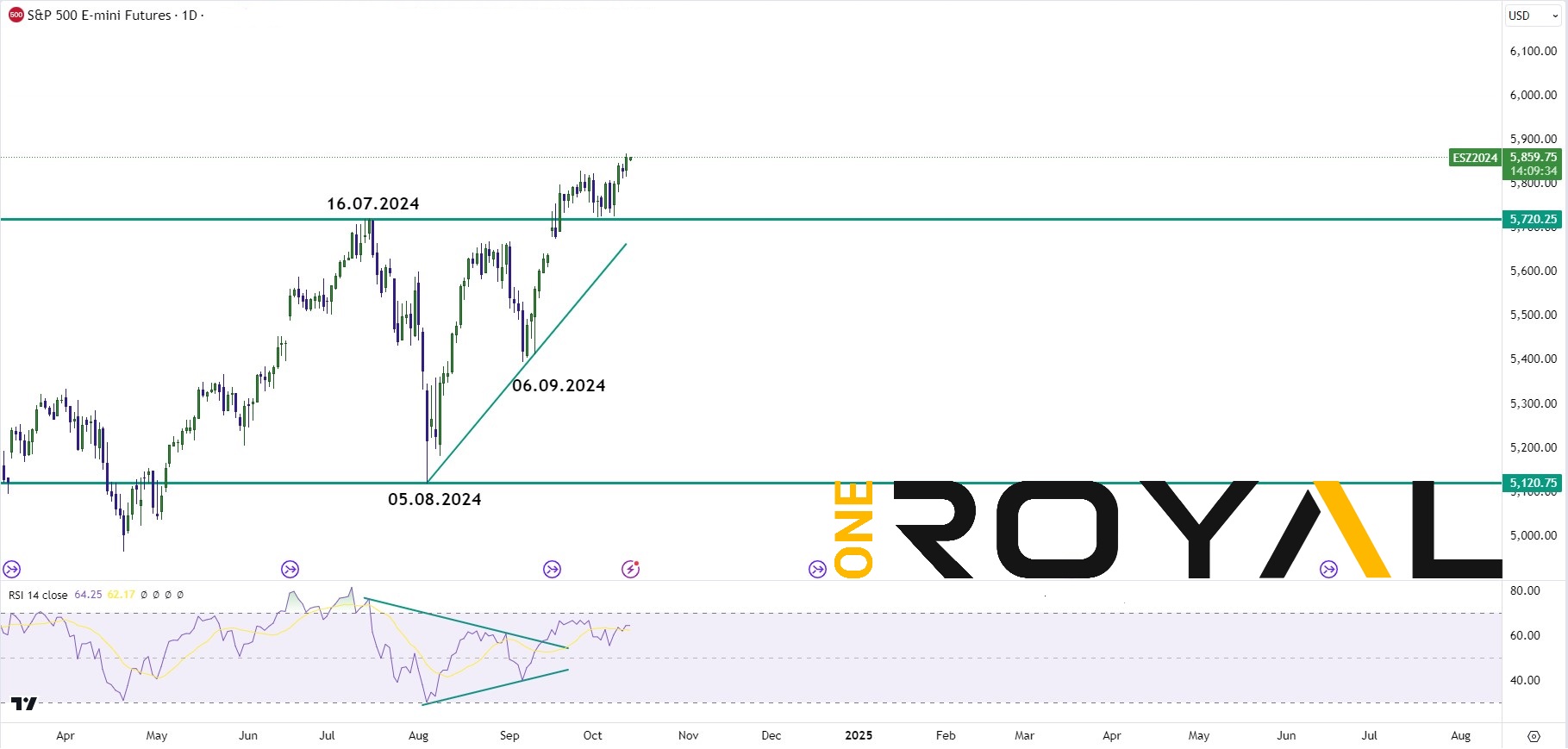

US Indices and more specifically the SP500 & the Dow Jones continue to make new all time highs with the US Tech and the Nasdaq to still remain below July’s peak ahead of the US Elections. In Crypto Bitcoin is still within it’s sideways accumulation phase and looking to potentially look for a breakout as several attempts have been made as of recent.

Market’s Technical Outlook:

US Dollar Index – Daily – Reached The 103 – 103.500 Area Of Potential Resistance

USDJPY Daily – At Potential Resistance Level At The 149 – 150 Area Looking For The Next Reaction

EURUSD – Daily – RSI Suggests That The Cycle From 27.06.2024 At Least Ended – At Potential Support Area of 1.09000

XAUUSD Daily – Cycle From 03.05.2024 & Most Importantly 25.07.2024 Remains Intact – Potential Bull Flag Breakout in Process That Might Expose the $2750 – $2800 Area

ES500 Mini Futures – New All Time Highs – Buyers Aim For The $6000 Area If The Momentum Maintains

Bitcoin Daily – Trading Within The Cycle That Started From 05.08.2024 – $70000 Area Remains The Key Barrier For Buyers

Those are the main highlights for the week ahead as the market will be looking for the path ahead with the upcoming data to justify the next moves. The lows from the 5th of August in Indices and Bitcoin appear thus far to remain important and buyers seem to be in control as of now as well as gold appears fairly strong with a potential bull flag breakout in play. Heading into the following week might turn out to be an interesting week ahead.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.