Hello Traders,

Following up with yesterday’s FOMC Meeting the Federal Reserve decided to cut interest rates by 50 bps vs the 25 bps that analysts were expecting. Comments from Fed’s Chairman Jerome Powell, included “that the Inflation is expected to continue lower overtime towards the 2% target range while the economic growth has been in line while a small softness in the labor market makes the cut appropriate in order to sustain the economic outlook and promote stability in the labor market.”

When he was asked about future rate cuts his comments were” We will take this step by step and looking at the data as a whole, if we consider appropriate to cut further we will do so”. Factors that may contribute to further rate cuts are weaknesses in the labor market, lower inflation, lower GDP, softness in consumer confidence.

Markets have been pricing in this 50 bps cut and now the question for the short term is whether a reaction could take place or if markets can continue to edge higher. With yesterday’s rate cut decision, we have see an initial move up but so far ends up to be a fake out spike and traders need to be aware for the short term technicals of the markets. Below we will see the technicals and pivots for EURUSD & XAUUSD for the short term.

EURUSD 4HR – Still below 26.08.2024 peak – A Double Correction Cannot Be Ruled Out Yet – 1.12035 Key Level For The Bulls

XAUUSD 4HR – Can Bulls break $2600? – False Breakout Might Provide A Pullback First – 2 Trend lines To Watch For Potential Support

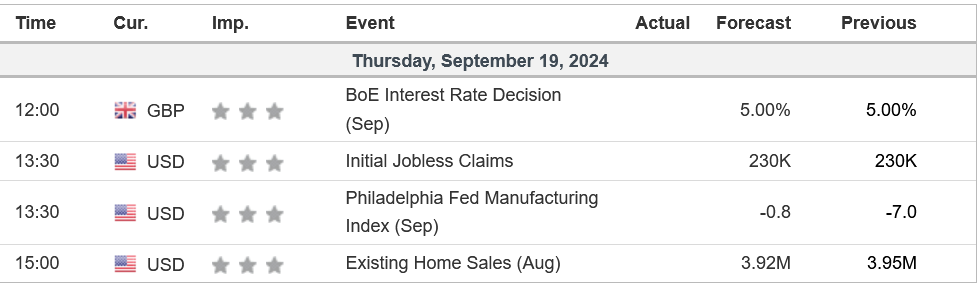

Traders need to pay attention to today’s news as well with US Jobless Claims, PFMI at 13:30 GMT & Existing Home Sales at 15:00 GMT and before that we have BoE’s Interest Rate Decision which will be interesting to see whether they should maintain the 5% rate or follow the steps of ECB & US. Analysts expect to remain neutral at the 5% mark.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.