Hello Traders,

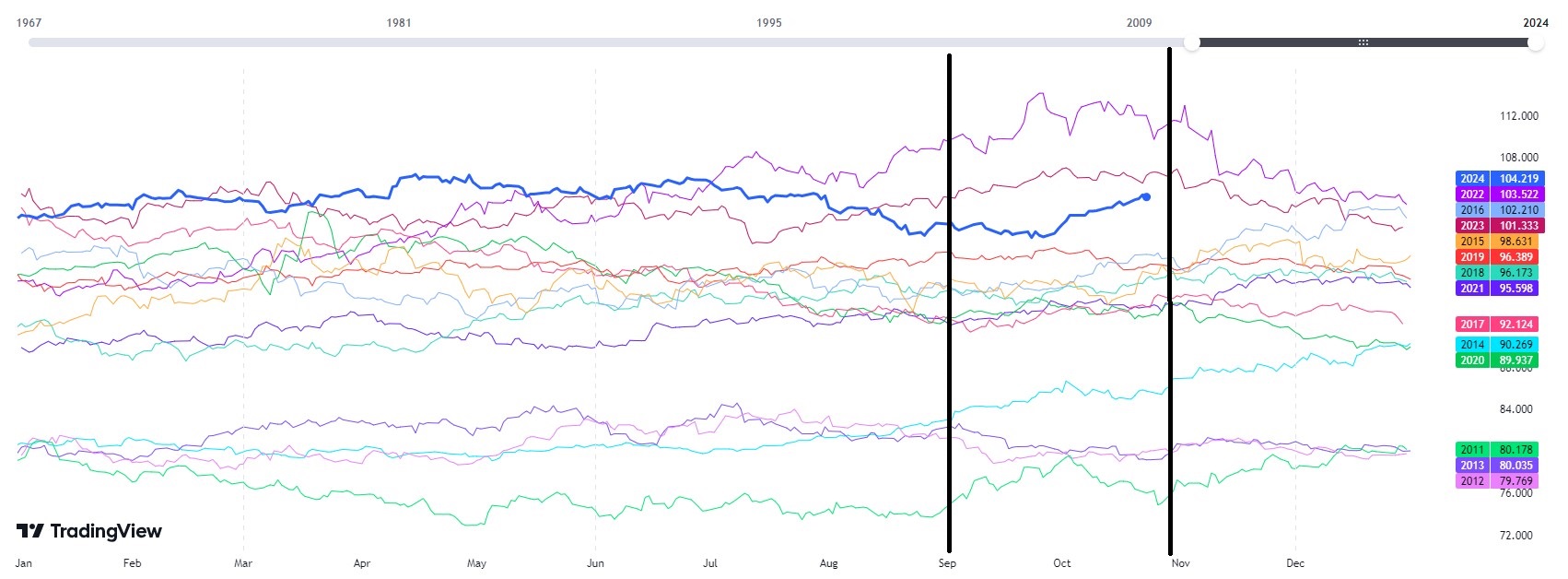

As we are approaching the end of October, before a busy month of November with US Elections this year and FOMC right after, we have seen yet another year in which the US Dollar has performed relatively and overall positive for this Fall season. Below we have filtered data from 2012 to this date so that we can see the period between September and November within the Fall season.

As we can see the majority of the years the Index has been performing relatively positive during the Fall season with at least a sideways to higher dynamic. Exception to this were 2012, 2013 & 2019 with these 3 years having a sideways to lower dynamic for the Index.

This year things started with a weaker Dollar with a rapid shift happening from the end of September.

USDX – 4HR – September Sideways To Lower Turns Higher Into October

As seen from 27.09.2024 the Index had a gain of 4.41% into yesterday’s peak. The impact affected major currency pairs such as the EURUSD, GBPUSD, USDCAD, USDJPY & more. As we are heading eventually into the 3rd month of this Fall season, November should be a key data driven month as there are 3 major key events and economic releases to look out for. Those are the Nonfarm Payrolls, US Elections & the FOMC Interest Rate Decision.

Volatility should be expected as a potential scenario with all 3 events taking place within a week’s timeframe and traders should be aware, as the Index might remain data driven during the upcoming month and each of the 3 events may cause ups and downs in volatile trading sessions before the market picks up the next possible trend move ahead.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.