Hello Traders,

So far 2024 has been an interesting and significant year for the financial markets with certain financial instruments seeing massive moves and growth, while volatility has been a key factor as of the last few weeks. In this article we will dive deep and see a couple of exceptional performing runs that we had so far this year. We are going to take the biggest performing instrument per asset class. This will be based on the best performing run with specified dates and the biggest % of change within 2024. Important to note that the following assets which are presented are also in consideration upon availability throughout our MT4 & MT5 platforms.

- Biggest Move In Forex – GBPJPY Rally From 179.100 Area to 208.100 Area Representing a 16.17% move

2. Biggest Move In Precious Metals – XAGUSD – Silver Rally from 23.750 Area to 32.500 Representing a 36.92% move

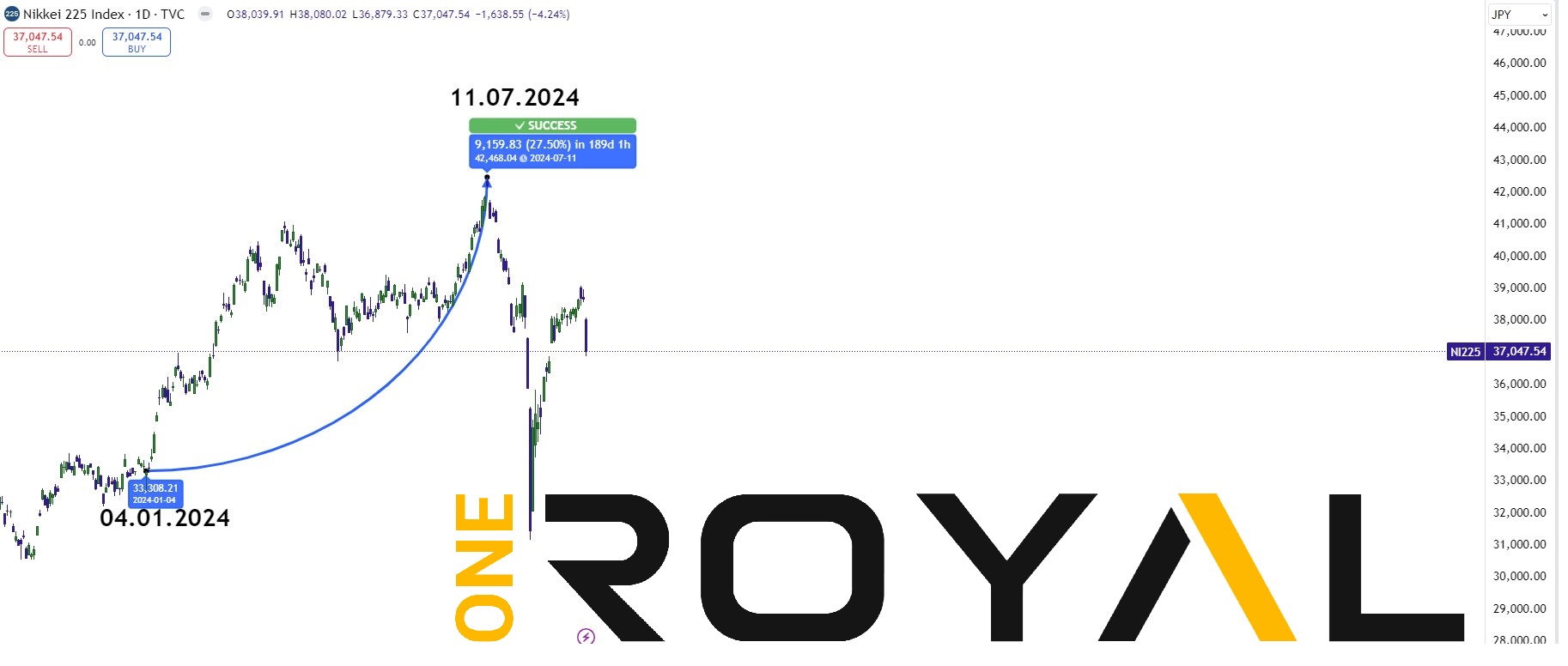

3. Biggest Move in Indices (Equities) – Japan225 Index (NIKKEI) – Rally from 33300 Area to 42468 representing a 27.50% move

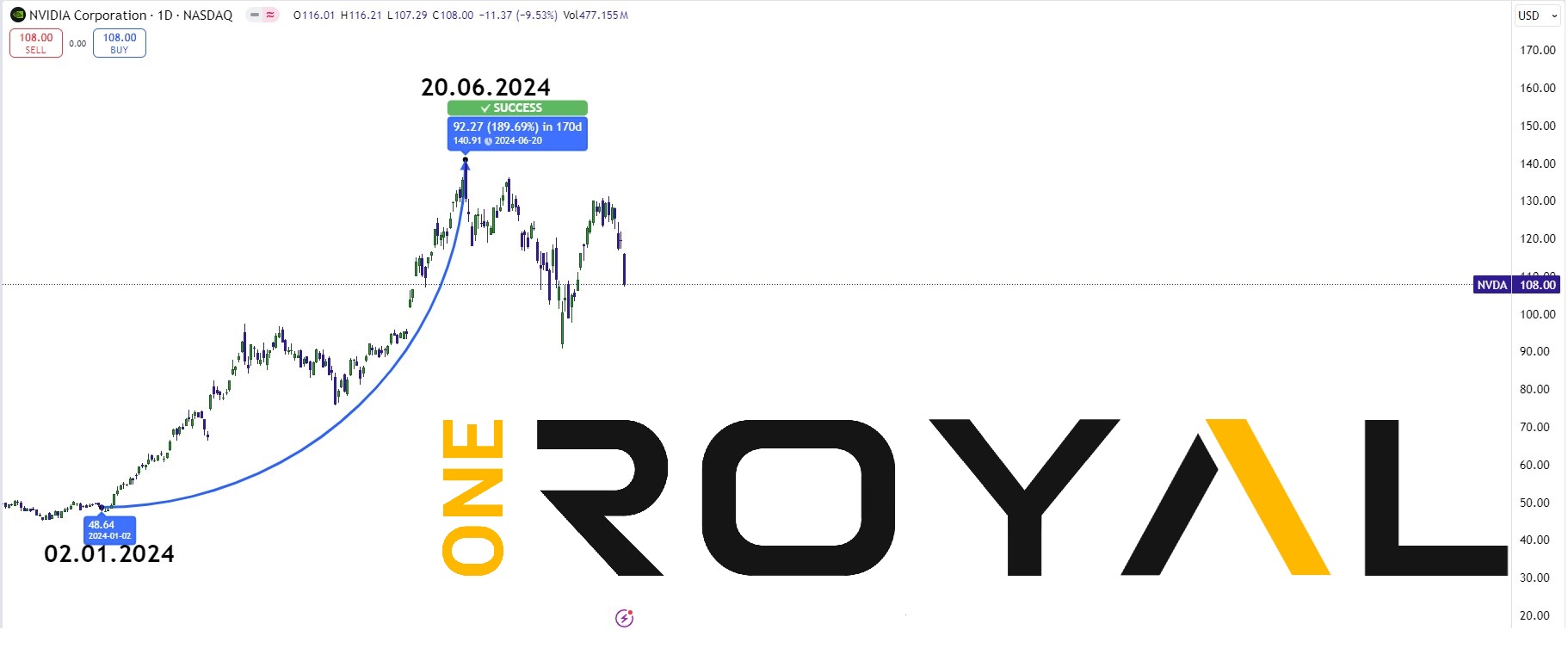

4. Biggest Move In Stocks – Nvidia (prices after shares split) Rally from 48.64 to 140.90 area representing a 189.69% move

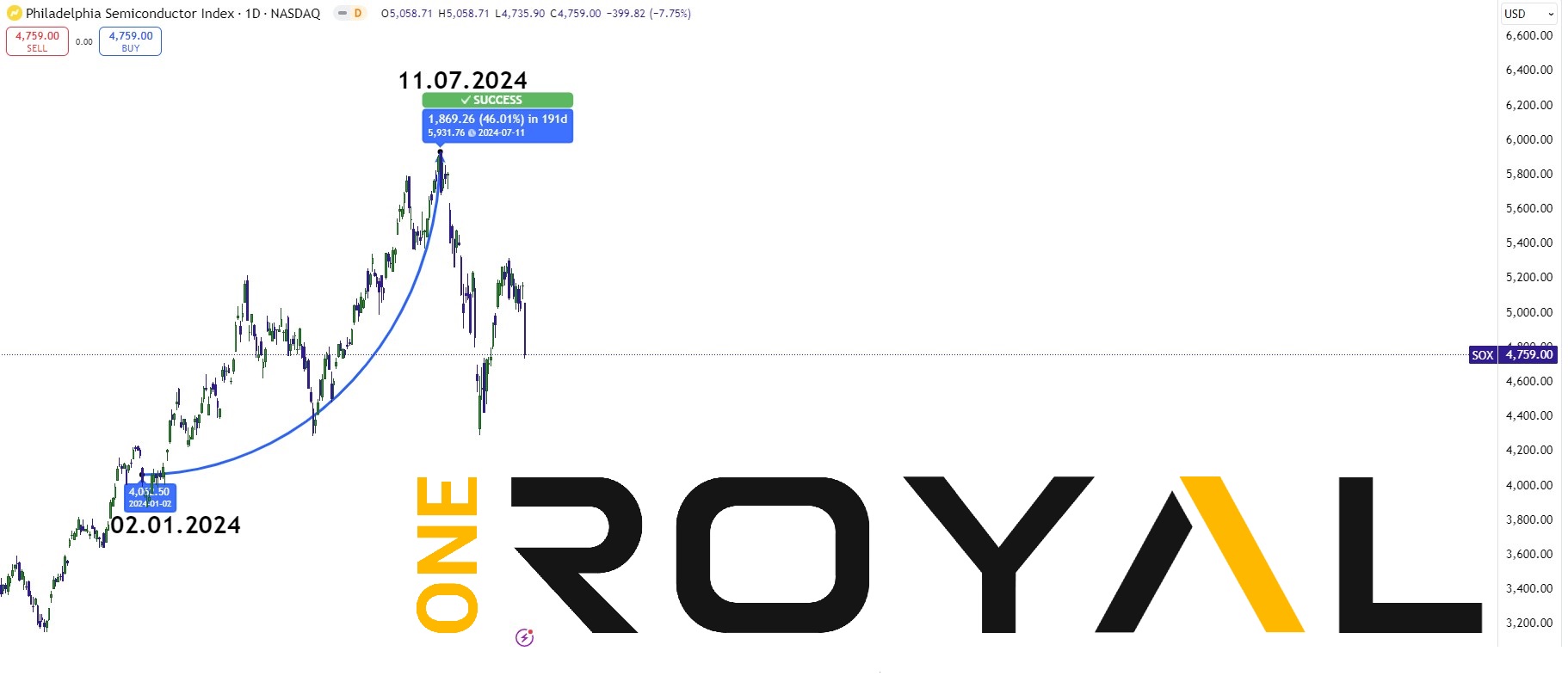

5. Biggest Move In US ETFs – PHLX (Philadelphia Semiconductor) Rally from the 4000 area towards the 5930 area representing a 46% move

All the above instruments are available for trading through our MT5 accounts and on MT4 excluding stocks and ETFs. If you are new here and you do not already have a trading account, you can register at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.