Hello Traders,

Earlier during today’s Asian session, New Zealand’s central bank cut rates by 0.50% bring the rates down to 4.75% from 5.25% in a move which follows up along ECB & US Federal Reserve shift in monetary policy from hawkish to dovish. FX Markets and more specifically the New Zealand Dollar has been declining over the last 2 trading weeks as US jobs market recovers while the local’s rate cut puts pressure for the currency.

The decision to reduce the cash rate to 4.75% was in line with market pricing and most economists’ expectations, with 17 of 28 economists in a Reuters poll having forecast the Reserve Bank of New Zealand (RBNZ) to cut the benchmark rate by half a percentage point.

“The Committee agreed that it is appropriate to cut the OCR (official cash rate) by 50 basis points to achieve and maintain low and stable inflation, while seeking to avoid unnecessary instability in output, employment, interest rates, and the exchange rate,” the central bank said in its policy statement.

NZDUSD 4HR – Technical Outlook

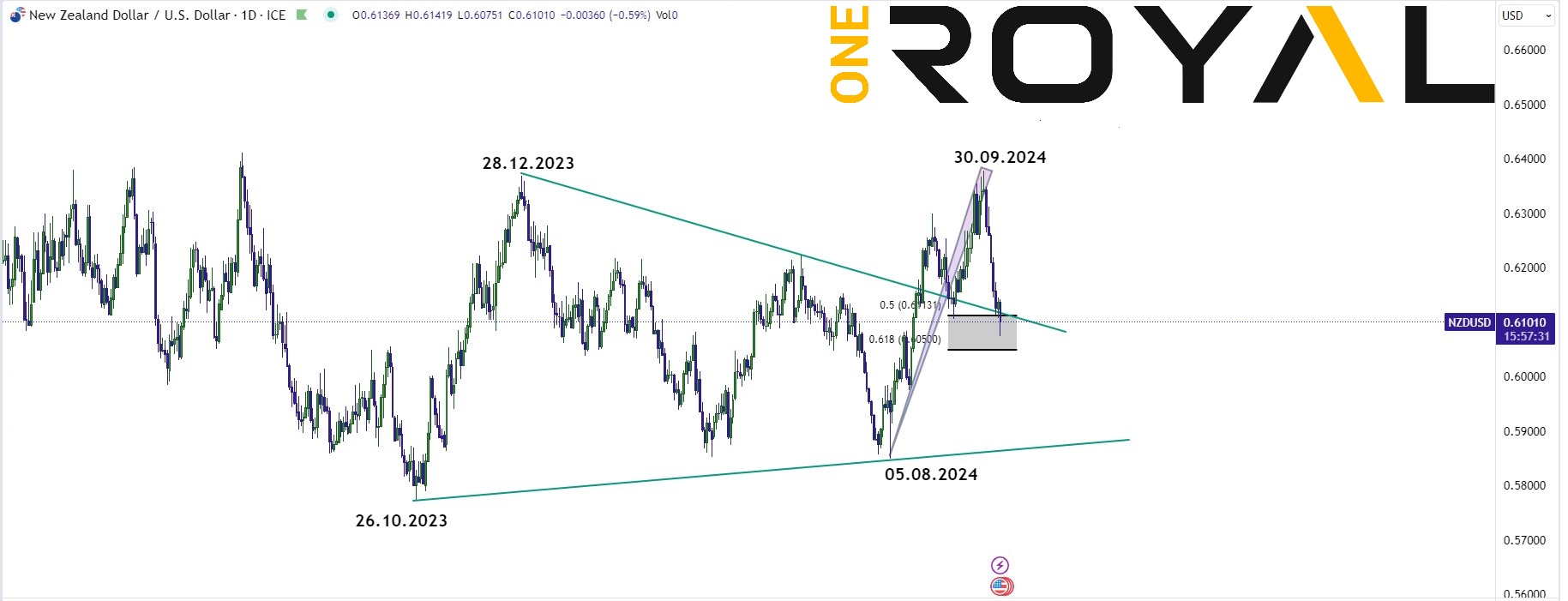

The NZDUSD has dropped by 4.80% since the recent peak at 0.63790 on 30.09.2024, while on the technical side it has reached the 0.5 – 0.618% Fibonacci retracement from the lows from 05.08.2024. The RSI suggests that the pair is at least correcting the cycle from early August while reaching at a key area in which buyers might attempt to take the lead. Failure to do so might impose risks to the downside longer term.

NZDUSD Daily Time Frame – Broke 28.12.2023 Highs But Fails To Carry Momentum Currently – Q4 2024 Might Be Key

As we can see in the daily time frame the pair broke the sideways triangle which was in from 28.12.2023 into 05.08.2024 lows and made a new high above it, however it fails to sustain the momentum and dropped. Heading into the following trading sessions and US Elections ahead, while the day after another FOMC meeting, makes Q4 2024 a key quarter for the pair’s longer term trajectory. Any further rate cuts from the US and more signs of inflation cooldown might provide support for the NZDUSD while any surprising data might impose further risks and more sideways price action in the daily time frame.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.