Professional Technical Analysis of Gold: Buying Opportunities and Potential Scenarios

By: Motasm Adel, Financial Markets Analyst at OneRoyal

Publication Date: February 19, 2025

Introduction

Gold continues to shine in global markets, reaching new historic highs. The precious metal remains a safe haven for investors, especially amid geopolitical and economic turmoil. In this analysis, we will review the key technical levels for gold, potential scenarios, and available investment opportunities.

Key Technical Levels

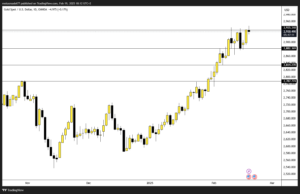

- Current Resistance: Gold is currently trading at a strong resistance level of $2,935 per ounce. This level has seen price rejection three times on the four-hour timeframe, indicating the formation of an accumulation zone at this resistance.

- Primary Support: The main support level is at $2,882 per ounce. A break below this level may indicate a deeper price correction.

Potential Scenarios

- Bullish Scenario:

- Condition: A strong daily candle close above $2,935.

- Expectations: If this condition is met, the upward trend is expected to continue towards $2,980, potentially reaching $3,000 amid rising geopolitical tensions.

- Recommendation: Look for buying opportunities on shorter timeframes after confirming a daily close above $2,935.

- Bearish (Corrective) Scenario:

- Condition: A clear break below the support level of $2,882 on the daily timeframe.

- Expectations: In this case, short to medium-term selling opportunities may arise, targeting the following levels:

- $2,840

- $2,787

- Recommendation: Set appropriate stop-loss orders to minimize potential risks.

Conclusion

Gold is currently trading within the $2,935 – $2,882 range. Stability above $2,935 could pave the way for further upside, while stability below $2,882 could lead to a corrective decline. Investors are advised to closely monitor these levels and make decisions based on market movements and global developments.

Review of Other Metal Prices (as of February 19, 2025):

- Gold: Gold prices decreased today by -0.26%

- Silver: Silver decreased today by -0.80%

- Platinum: Platinum decreased today by -2.15%

Note: Metal prices are influenced by multiple factors, including supply and demand, global economic developments, and currency fluctuations. Investors are advised to follow daily price updates and consult reliable sources before making investment decisions.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consult a qualified financial advisor before making any investment decisions.