Hello Traders,

The US CPI results were out earlier this afternoon, in line with analysts forecasts but the US Core CPI (MoM) for August, was slightly higher than expected at 0.3% vs 0.2%. (data provided from investing.com)

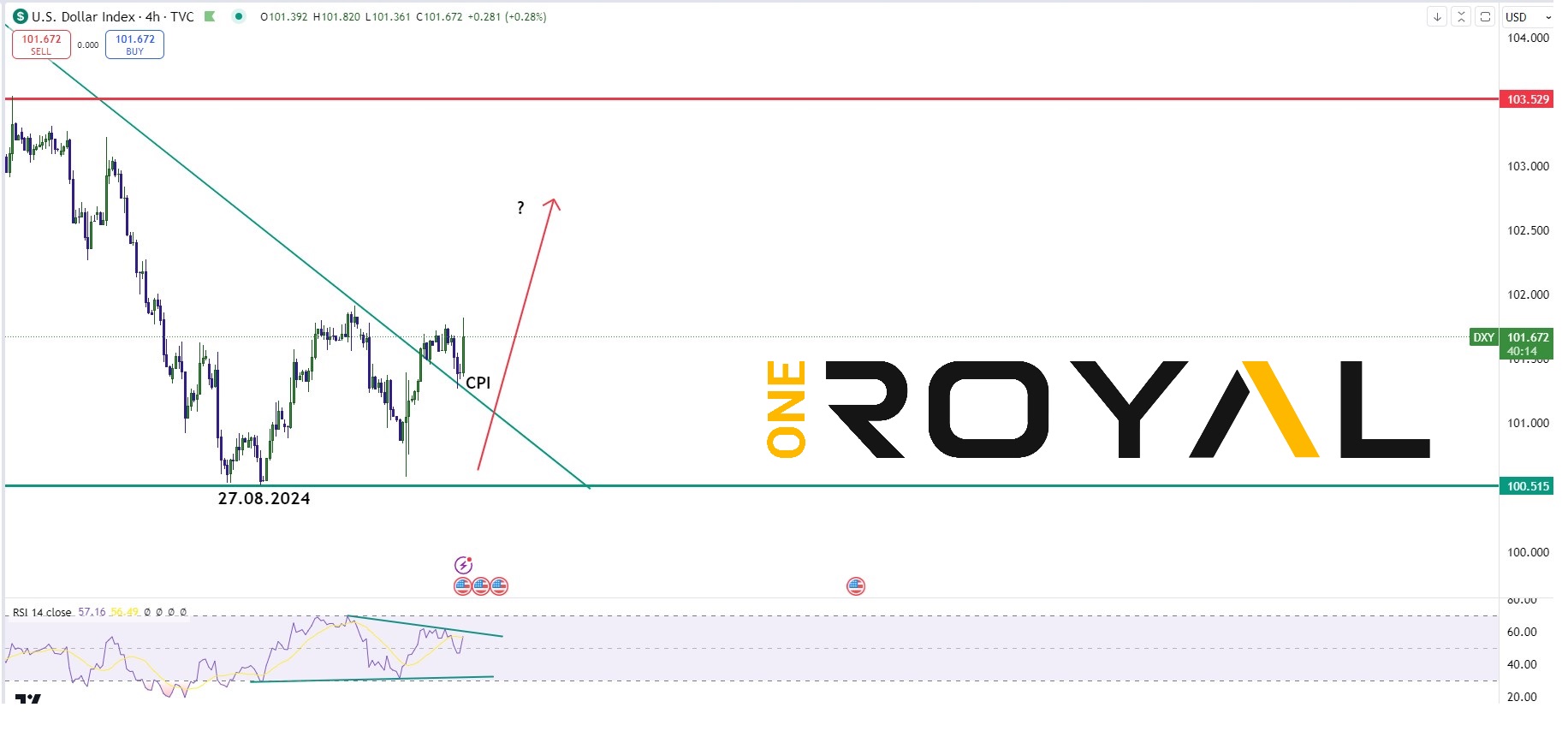

This has cause the US Dollar to react higher and now the focus is turned for tomorrow’s PPI for the next reaction. The question now is whether PPI comes out higher than expected and creates a continuation higher for the US Dollar Index or whether it might be in line with forecasts or lower and generate the reverse reaction. Let’s have a look at our major instruments and their reactions from the release today.

USDX 4HR – So far the breakout could be intact for the 103 area – RSI Needs To Follow Up With A Breakout – Tomorrow’s PPI release might be key

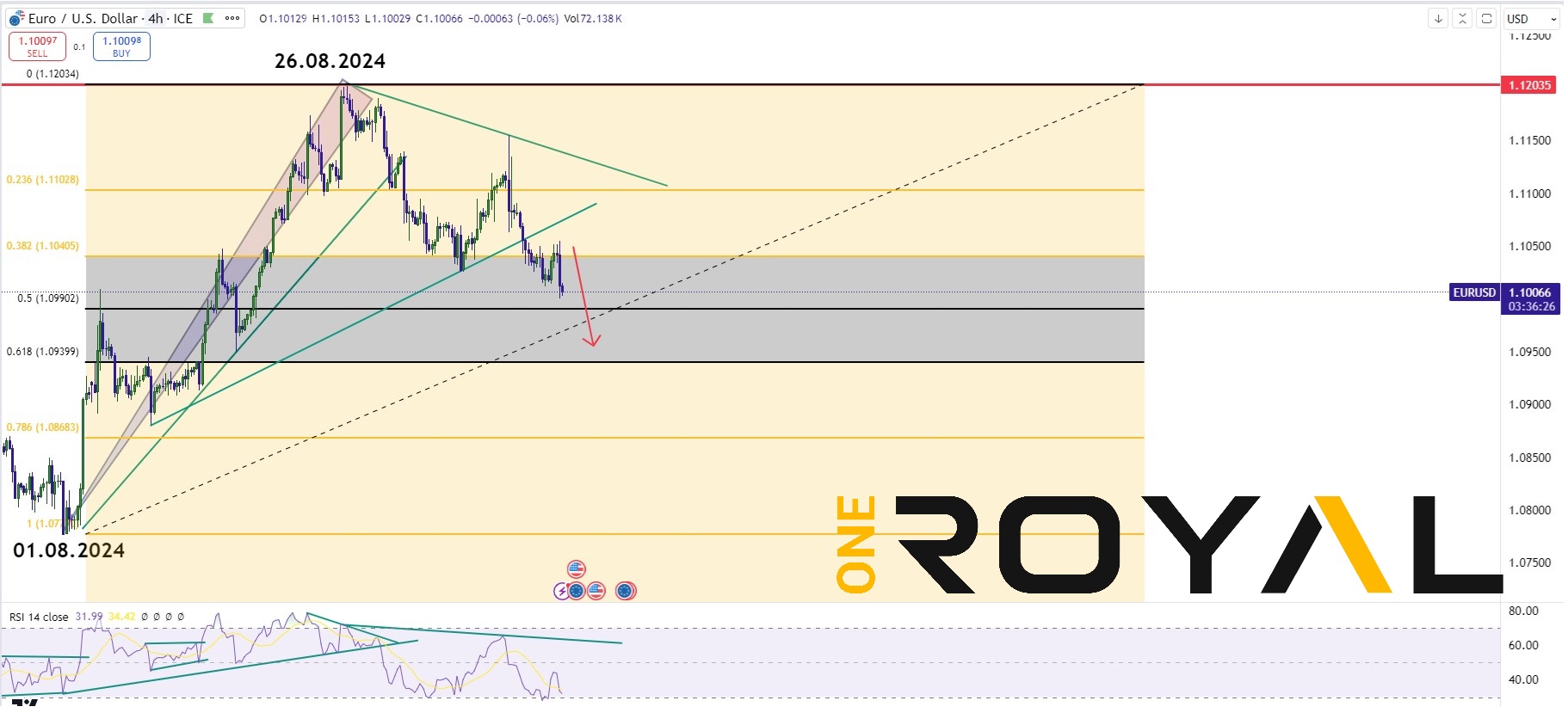

EURUSD 4HR – The Path Towards the 1.09500 Could Remain Intact – ECB’s Interest Rate Decision Tomorrow & PPI Could Be Key

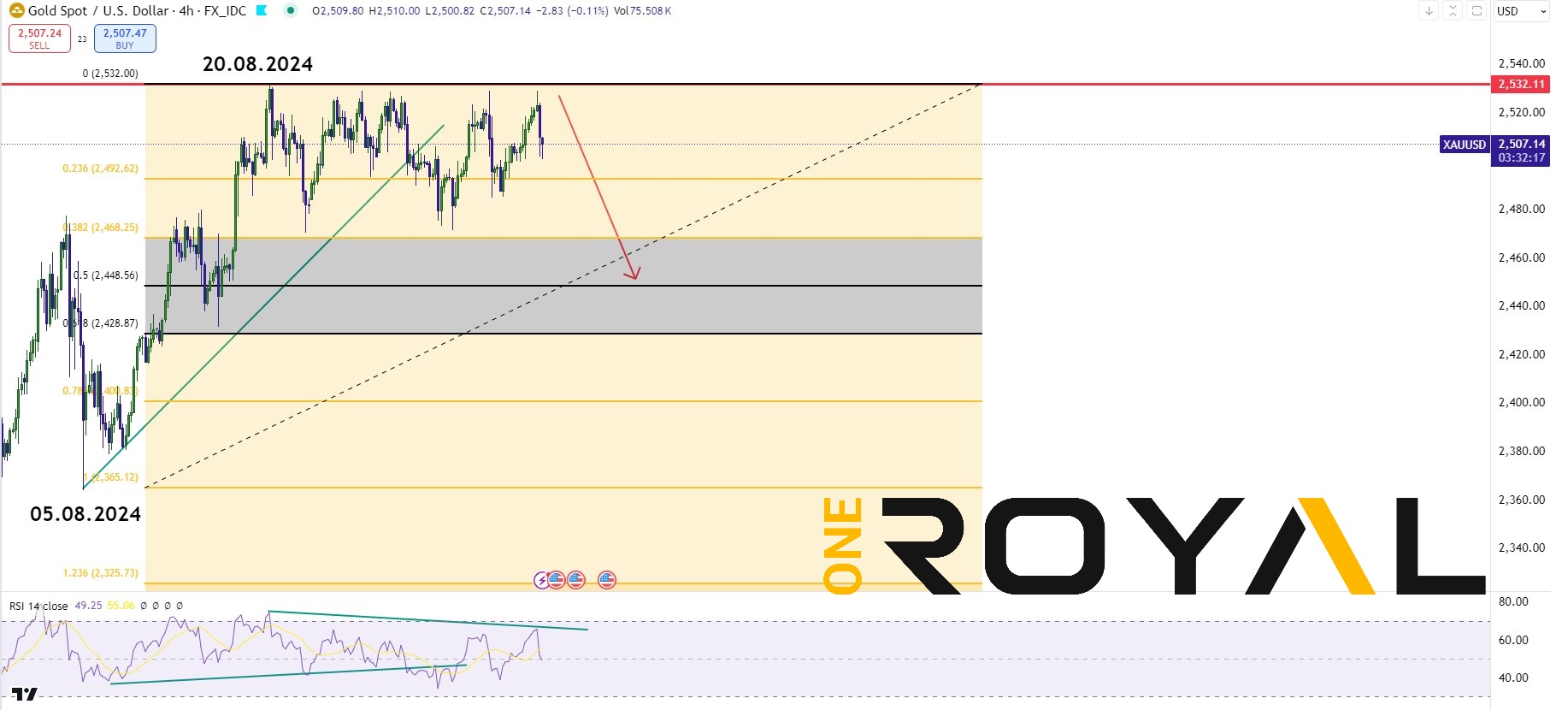

XAUUSD 4HR -Reaction Lower Could Intensify Into The 0.5% – 0.618% Fib Retracement If A Higher PPI Releases Tomorrow – As Long As USDX Continues Higher

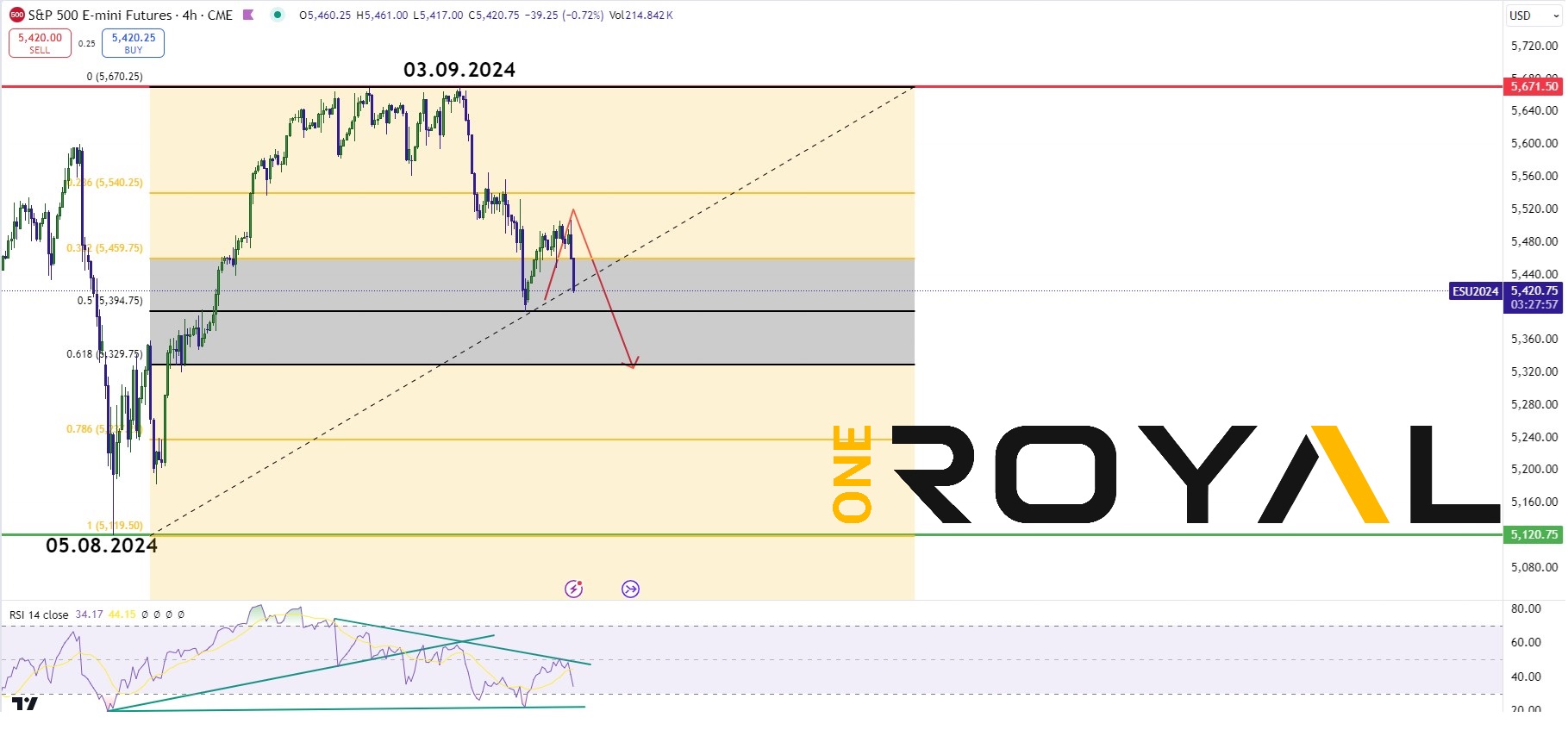

ES500 Mini Futures – 4HR Could Be Heading Lower Towards The 0.618% Fib Retracement Levels From 05.08.2024

Those where the current reactions post CPI and the market trading into tomorrow’s ECB’S Interest Rate Decision in combination with the US PPI release might be key in order to either continue the current path or provide any reverse reactions across the market.

Traders should be looking into those next. If you are new here you can sign up for a trading account at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.