Hello Traders,

Following up our last week’s article about Silver & Gold (https://blog.oneroyal.com/blog/the-rise-of-metals-hedge-against-inflation-a-look-at-silvers-cycle-vs-gold-since-2020-whats-next/ ), one related ETF we can have a look at for a potential link between them is the GDX (VanEck Gold Miners ETF). In this article we will analyze the weekly timeframe cycle of GDX and relate it to Gold with some key pivotal dates.

Firstly a few things about VanEck and GDX itself. VanEck is an American investment management firm headquartered in New York City. Founded in 1955 by John van Eck, the firm is primarily engaged in issuing exchange-traded fund (ETF) products although it also deals with mutual funds and separately managed accounts for institutional investors. It was a pioneer of investing in foreign growth stocks as well as gold investing.

Regarding GDX, the fund normally invests at least 80% of its total assets in common stocks and depositary receipts of companies involved in the gold mining industry. The index is a modified market-capitalization weighted index primarily comprised of publicly traded companies involved in the mining for gold and silver. The fund is non-diversified. The ETF has been utilized as an alternative investment & trade to Gold. The VanEck Vectors Gold Miners (GDX) ETF is one of the most liquid vehicles on the market. It helps those who want to gain exposure to gold mining companies. It was established in the midst of gold’s bull market as securities were created to satiate the appetite of precious metals investors. It launched on May 16, 2006. Its shares are listed & trade on the NYSE Arca, an electronic exchange meant specifically for exchange-traded products, such as ETFs, exchange-traded notes (ETNs), and exchange-traded vehicles (ETVs).

*You can trade GDX ETF through our MT5. https://www.oneroyal.com/en/markets/instrument/GDX

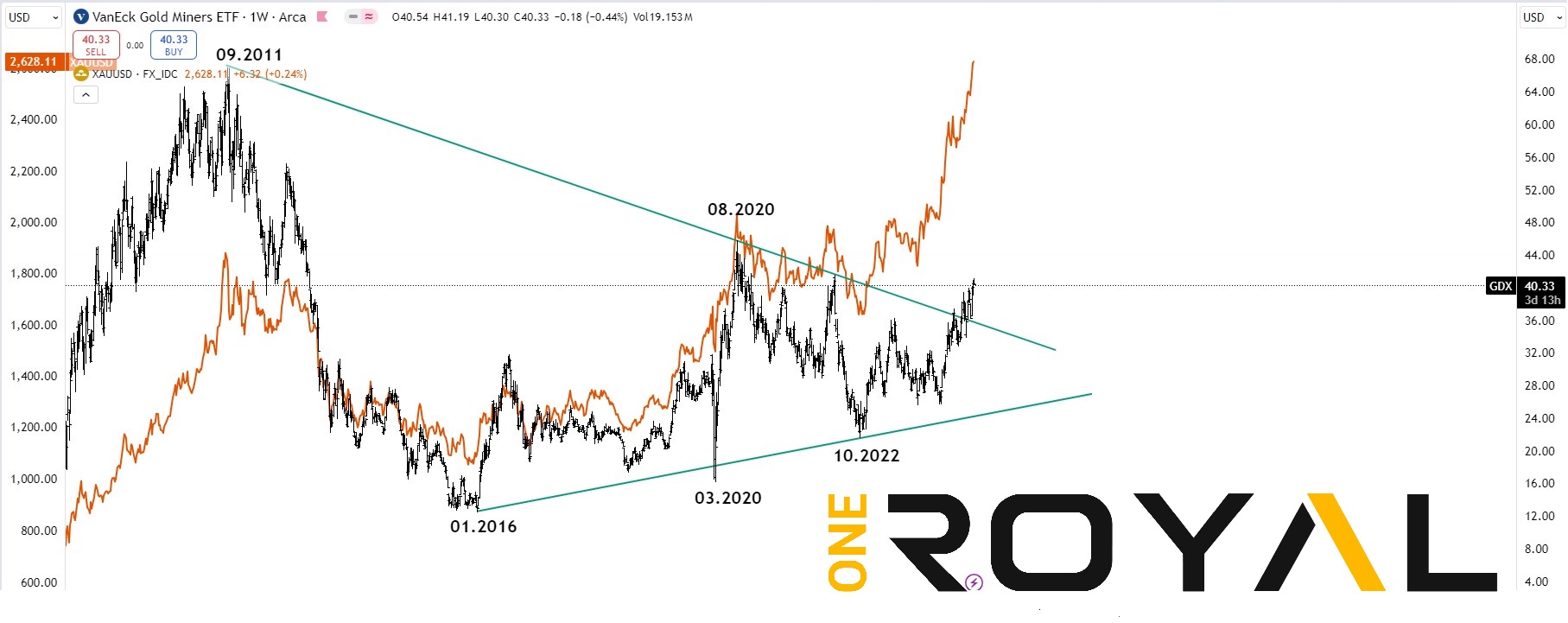

GDX Weekly Time Frame Cycle From 2016 With Some Key Pivotal Dates – Potential Breakout From 2011 Descending Triangle In Process

GDX VS GOLD (XAUUSD) – Gold Leading – Will GDX Catch up?

As we can see Gold has been the leader thus far since 2021 – 2022 overall. In terms of the moves it is apparent that they both move together in the same direction, however the performance of GDX in the last couple of years has been lagging and poor compared to Gold itself. Given the recent breakout of the multi year descending triangle, the question is whether the ETF can catch up and perform over the near future and catch up with the performance of Gold. That is something that traders and investors should be looking at and evaluate whether GDX ETF might be a value bet within the recent market dynamics and a potential hedge against inflation, political instability and uncertainty and act as a follow up trade to the move we have seen in Gold since Q4 2022.

You can trade GDX ETF through our MT5. https://www.oneroyal.com/en/markets/instrument/GDX

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.