Hello Traders,

Heading into this new week after last week’s US CPI % retails sales data the focus is shifting towards the European & UK CPI numbers alongside with US Manufacturing data. Last week the US CPI came out at 2.6% vs the 2.4% from the previous month, jobless claims at 217K against the 224K forecast and a mixed outlook for retail sales allowing the US Dollar to remain overall supported for the week. Additionally, US Fed’s Chairman Jerome Powell during his speech hinted that there’s no need to be aggressive with Interest Rate cuts at this point and that the US Economy remains healthy overall with inflation expected to have a bumpy road ahead but overall continue it’s path towards the 2% target level for the CPI (YoY). The overall comments and economic data allowed the dollar to sustain the cycle higher from 27.09.2024.

Weekly Calendar – High Impact News In GMT (investing.com)

Let’s see what the technical outlook might be presenting for this week ahead onwards looking at the main major instruments across Forex, Commodities, Indices & Crypto.

USDX – Key Week Ahead – RSI Trendline In Focus To Determine Potential Exhaustion From 27.09.2024 Rally & A Potential Reaction Might Be Ahead

EURUSD – 8H RSI Divergence Hinting To A Potential Bounce That Might Be Taking Place After Reaching The 1.05000 Area

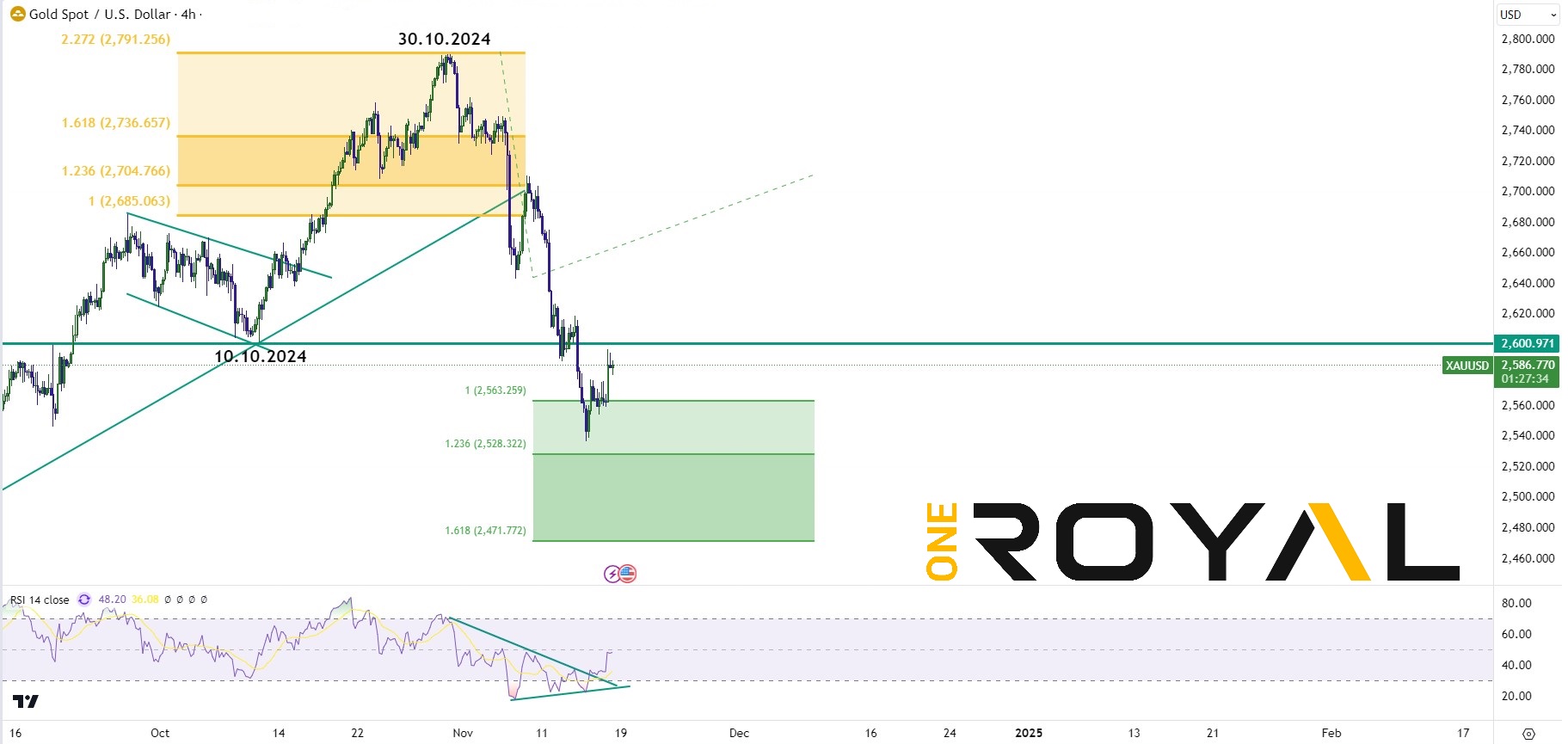

XAUUSD – 4HR RSI Channel Appears To Be Breaking Out – Potential Bounce In Progress

ES500 Mini Futures – Cycle from 05.08.2024 Remains Intact After Reaching The $6000 Area As Far As Trendline Holds – Otherwise A Deeper Pullback Might Take Place

Bitcoin – Bullish Momentum Remains Intact – Shorter Term As Far As Above The Minor Trendline Could Make New All Time Highs – Otherwise A Deeper Pullback That Should Remain Supported Might Be In Play

That is the overall technical market outlook entering to this week ahead. Main focus should be in how the US Dollar should react and whether the divergences and potential support areas in EURUSD & Gold should provide with a recovery bounce or reaction across the week and before next week’s Thanksgiving in which Thursday & Friday 28th – 29th of November could see very low trading volumes in the absence of US traders.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.