Hello Traders,

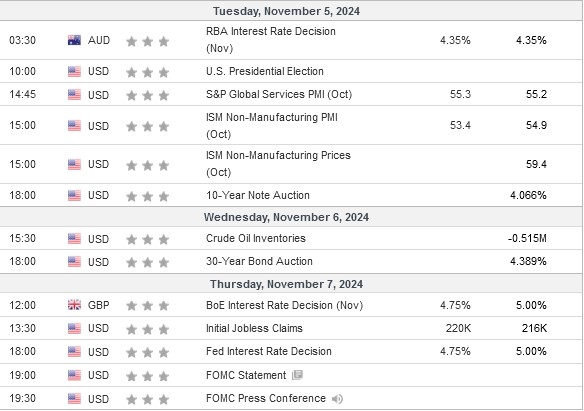

US Elections week has arrived with the FOMC Interest rate decision right after, into a potential volatile week ahead of us. Lats week the NFP numbers were negative with only 12K new jobs added in the month of October against the 106K forecast and 223K in September, with the unemployment rate remaining stable at 4.1%. The market overall hasn’t reacted much to the new jobs data which saw a big reduction in new jobs, with the expectation of the US Election and the Fed’s rate cut of 0.25% this Thursday, 7th of November. The first high impact news begin on Tuesday, November 5th with RBA’s Interest rate decision in which forecasts are expecting rates to remain stable at 4.35% for the Australian bank.

The main key day appears to be Thursday, 7th of November in which Bank of England is expected to cut rates by at least 0.25% while the US Federal Reserve is expected to do the same post the US Elections. As the jobs data last week showed more weakening it should be a dilemma whether they should do a more aggressive cut of the lines of 0.50% like they did last time in September.

Week Ahead High Impact News Calendar In GMT (investing.com)

The main sector that was mostly impacted from the negative jobs data last week were US Equities and most stocks, despite of certain positive Q3 Earnings reports for companies such as META, Microsoft, and negative for Apple regarding their EPS. US Indices such as the SP500, Nasdaq & the Dow Jones reacted lower in what seems to appear as a pullback for the time being.

Market Technical Outlook

USDX – Cycle from 27.09.2024 Showed Weakness Last Week Within Resistance Area – US Elections & FOMC Rate Decision Could Impose Volatility or Further Indecisiveness

EURUSD 4HR – Bouncing Within A Possible Support Area After 25.09.2024 Decline

XAUUSD – Reached the $2791.26 – Inverse 2.272 Fibonacci Retracement Target Area & Reacts Lower- RSI Suggests That Cycle From 10.10.2024 & A Pullback Seems To Be In Process

ES500 Mini Futures – NFP Produced A Pullback – $5720 A Key Area To Determine Whether A Double Correction Lower Or Trend Continuation from 05.08.2024 – FOMC Rate Decision Likely To Affect The Index

As the jobs data hasn’t provided any significant panic in the market, the overall psychology shows that investors are anticipating the US Elections and the FOMC rate decision and likely to be the decision maker in the overall market’s next potential bigger move ahead. Traders should also be paying attention to what the Fed’s chairman Jerome Powell saying during his press conference speech on Thursday to determine also what might be happening in the near future regarding the size and speed of nay further rate cuts ahead. It should be expected that major assets such as Gold, US Dollar and US Equities to remain sensitive to the event for the next moves ahead.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.